Malaysia Developers Awards 2022 judging session at Sunway Resort Hotel on August 10.-AZMAN GHANI/The Star

Strong economic recovery post-pandemic

Contributed by Tan Sri Abdul Wahid Omar

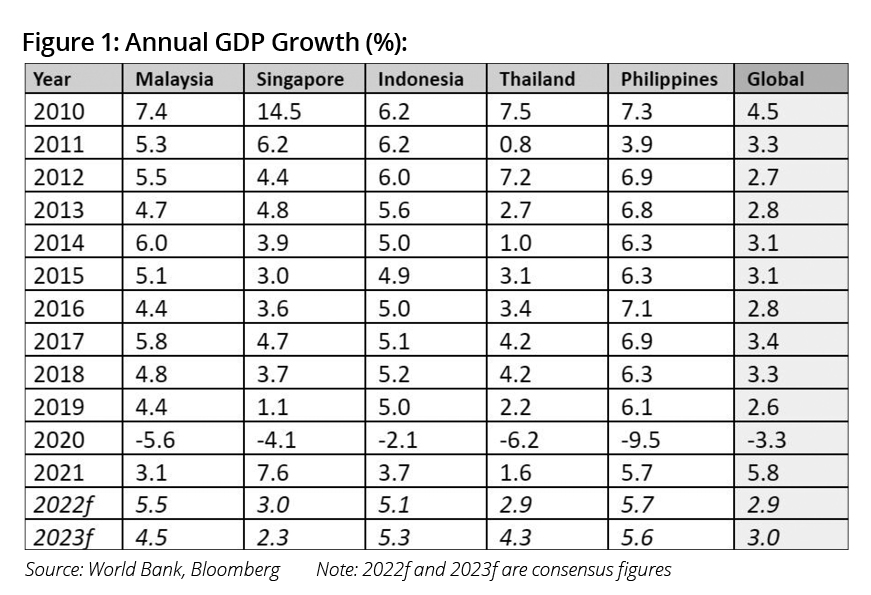

The global economy has shown strong resilience post-pandemic, amid fiscal support, pent-up consumer demand, easing of movement restrictions and borders reopening. Global Gross Domestic Product (GDP) grew by +5.8% in 2021, after contracting -3.3% in 2020.

Asean countries also saw GDP growth in 2021 – a notable factor, given Asean’s high level of economic integration, with the Philippines seeing a significant recovery of +5.7% year-on-year (y-o-y) growth, compared to -9.5% contraction in the previous year.

However, due to aggressive rate hikes by global central banks to combat the inflation effects of the pandemic, there is an increased risk of a global recession in 2023. Because of this, most economists have been conservative with their forecasts for 2022 and 2023 with the World Bank forecasting global GDP growth of 2.9% for 2022 and 3.0% for 2023.

Malaysia’s economy has also been building on the momentum of economic recovery. GDP growth has seen significant increases this year, with Q1 GDP growing by +5% y-o-y, followed by +8.9% and +14.2% for Q2 and Q3 respectively.

For the full 9M 2022, GDP grew by +9.3% y-o-y. This means that the full-year 2022 GDP growth is expected to exceed 7.0% before moderating to 4.5% in 2023.

While an economic slowdown is anticipated, Malaysia’s economy is well-diversified, with the services sector contributing 57.0%, manufacturing sector 24.3% and commodities (agriculture, mining and quarrying combined) contributing 13.8%.towards our GDP. This is expected to continue supporting our economic resilience.

Capital market outlook

Malaysia’s public-listed companies (PLCs) have released a slew of positive results in the recent quarterly earnings season with most large-cap stocks in-line or surpassing consensus expectations.

It was a good quarter for banks, in particular Maybank (net profit RM2.17bil; +28.5% YoY), Public Bank (net profit RM1.59bil; +16.8% YoY), CIMB (net profit RM1.41bil, vs net loss of RM101mil a year ago) and Hong Leong Bank (net profit RM981mil; +10%YoY).

As such, there is a strong case for their earnings growth potential and further economic recovery into the new year. According to Bloomberg, consensus also forecast Earnings Per Share (EPS) growth of 11.8% for the benchmark FBMKLCI in 2023.

All eyes on policy direction

The recent GE15 resulted in a hung parliament, with the appointment of Datuk Seri Anwar Ibrahim as Malaysia’s 10th Prime Minister to lead a unity government ending five days of political impasse. While a unity government is unprecedented in Malaysia, the removal of political overhang and more political clarity are factors that will serve to improve market sentiment. Additionally, the continuity of prevailing policy inclinations or a more friendly budget policy will be important to regain investors’ confidence moving forward.

The FBMKLCI is now trending upwards and there are higher hopes for the benchmark index to revert to mean valuations of P/E if the economy continues to recover strongly, and investors regain confidence in the new government’s economic and foreign policies moving forward. Other key market indicators such as total Market Capitalisation, ADV and Velocity should also react in the same manner, and we are excited to see how the market will react in 2023.

In November 2022, foreign funds remained net sellers of Malaysian equities, albeit with a small outflow of -RM282.1mil (Oct 2022: -RM577mil, YTD 2022: RM5.7bil inflows, 2021: RM3.2bil outflows). Renewed foreign interest could be seen following the appointment of the Prime Minister, with a daily net inflow of +RM340.8mil, the highest net inflow since 16 Mar (+RM396.29mil).

Retail investors turned net buyers, with a net inflow of RM95.5mil in November, up from RM133.1mil outflow in October. For the month, the Malaysian Ringgit strengthened +6.5% against the US Dollar, to 4.444 as of 30 Nov. The strengthening of the US dollar, rising interest rates and growing concerns of a global economic recession have caused volatility in the commodity and securities market, driving demand for CPO futures (FCPO) and KLCI Futures (FKLI) to hedge the exposure of investors’ underlying portfolios in 2022 and possibly into 2023.

Bursa’s 2023 sustainability initiatives

Bursa Malaysia has been paving the way for the development of ESG best practices and awareness in Malaysia for close to a decade, and we are happy to see the increased universal recognition of the concept of ESG investing in recent years.

The FTSE4Good Bursa Malaysia index was launched in December 2014 with 24 constituents. It has since grown to include 87 constituents as of June 2022 (+263%) and has the capacity and potential to grow even further, to cover our universe of 900+ PLCs. We have also seen improvements to ESG disclosures and practices, and the overall rating for Listed Issuers has improved from 1.31 to 2.47 in the same period.

Throughout 2022, the Exchange has continued to tie up with banks and financiers, as well as working with partners FTSE Russell on various ESG initiatives.

We have also conducted numerous roadshows with institutional investors to encourage ESG-based investing, and have recently launched our ESG advisory service, to increase awareness, encouraging better ESG disclosures and raising the number of constituents of the FTSE4Good index further.

The Exchange is encouraged to see that Malaysia’s ESG ecosystem has matured strongly to incorporate many participants.

- Banks and financiers are now offering loans based on ESG criteria;

- The media are extensively covering ESG developments and collaborating with Bursa Malaysia for ESG Awards;

- Institutional investors are increasingly integrating ESG factors into their investment portfolios;

- PLCs are more aware of ESG practices, leading to higher ESG ratings; and

- An increasing number of PLCs are participating in our ESG advisory services

Additionally, the Exchange has recently inked a sustainability MoU with the London Stock Exchange Group (LSEG) to expand the coverage of ESG scores to include all PLCs listed on the Main and ACE Markets, as opposed to the current coverage of approximately 30% of total Malaysian PLCs.

Bursa Malaysia will also be launching the Voluntary Carbon Market on 9 December, in support of Malaysia’s commitment to address climate change and achieve our 2030 Sustainable Development Goals.

Through these successful initiatives, the Exchange is confident that Malaysia’s capital market will remain relevant to the global investment environment, and we expect many exciting years ahead/beyond 2023.

We are also pleased to announce that Bursa Malaysia will be rolling out one of our flagship events, the Bursa Bull Charge, in 2023, after a two-year pause due to COVID-19, and are excited to see participants take to the streets to run for others again.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.