Ultimately the best time to buy a property depends on a person’s finances

By Joseph Wong

Many property buyers and investors continue to retain the view that timing is the most important factor in the real estate market and put off purchasing in the hope that a better opportunity will arise if they wait.

In actuality, there is no perfect moment to purchase a home. The best time to buy a home is when one can afford it and the property should not be seen as a get-rich-quick. Real estate is a long-haul investment because properties often increase in value over time. It happens gradually.

Many seasoned investors and home purchasers are aware that the longer one waits to purchase a home, the more expensive the home will end up becoming. Hence, buying when one is financially able makes good sense.

Unfortunately, the general population still believe that it is the timing that matters most when it comes to the property market and holds back on buying on the expectation that a better deal will come along if they wait. This can be seen over the last two years when property prices were at their lowest points and when good deals were offered, including the Home Ownership Campaign (HOC) versions 1 and 2.

Ironically, during these periods when conditions were favourable towards buyers, there were still stragglers, choosing to wait longer, expecting better deals to come along. In sharp contrast, the more experienced know that it is timing, not time, that makes money in the property market.

Pre-election mood

And given the pre-election mood, the timing could not be better. Malaysian Institute of Architects (PAM) president Sarly Adre Sarkum believes that it is a good time to buy even though the interest rates have risen as the property market was still weak, meaning that there would be good deals available.

From past experiences, the pre-election periods have usually seen a slump in property transactions, meaning that it would be a good time for house buyers to bargain hunt. Property transactions usually pick up after elections, Sarly added.

Pejuang Hartanah founder Ahyat Ishak is a little more philosophical. He said there are two perspectives to consider where timing is concerned. “When it comes to timing, we have to consider whether it is a good time in the market or a good time for the individual,” he said.

This is the consideration that potential home buyers and investors need to answer before they make the leap, he surmised, reasoning that just because the market might present a good opportunity does not mean that it is the right time for an individual as he or she might not yet be financially capable to handle the monetary commitments that come with owning a property.

On the property market timing, he would agree that it is an opportune time to buy a property given that the market prices had been depressed over the last few years after it peaked in 2011-2012.

The real estate market started declining for a period of over six years until 2019 when signs were showing that it had bottomed out in 2018. However, an unprecedented occurrence happened that nobody foresaw – the outbreak of Covid-19 in 2020. This hampered the economy as well as the property market as Malaysia and the world scramble against the pandemic and the effects caused by the multiple movement control orders.

Bad times, good buys

Given that the property market is showing signs of improvement recently so to that effect, Ahyat agreed that this would be a good time to buy a property. “People say the property market is bad but bad for whom? It might be bad for the sellers and if it is bad for the sellers, then it must be good for the buyers, right?” he said.

Ahyat, who is also a property investor, public speaker and author, is optimistic that the market will recover next year. “The property market was increasing during the pandemic period, not a big increase but it is an increase, nonetheless,” he said, pointing out that if the property market can improve under the endemic conditions, it is likely to experience a stronger recovery.

However, from his own findings, about 70% of today’s buyers are not ready to buy property despite the favourable buying conditions. The reasons range from a drop in personal earnings to job instability and financial constraints.

“If the time is right for you and the market conditions are right, then it is time for you to sniper for the best deal,” he advised potential buyers and investors who have been holding back their purchase.

For the financially able, now is a good time to buy, said Savills Malaysia managing director and head Datuk Paul Khong, pointing out that those who do sign the deal should ensure that they have sufficient funds to ride through the difficult times.

“Inflation, Covid-19, petrol price hikes, the Russian-Ukraine war and the elections are basically causing uncertainty,” he said. Following the buy low-sell high strategy, Khong said the price of properties are generally at the lower bracket and over the last few years, the market has seen various impairment in values.

“The market prices were further impacted during the Covid-19 pandemic which continued into 2022. However, there is a cost-push in construction costs and land prices.... this will force property prices northwards for new builds and this will probably carry through to the secondary markets,” he explained.

Missing the boat

So going forward, property prices are expected to rise. “If those holding back their purchase waiting for a better deal to come along might end up missing out,” said a property investor. “Once the prices start rising, they will already have missed the boat. Because this is the time that sellers will realise that they can get a higher price for their property and the negotiation advantage will shift from the buyer to the seller,” he said.

“I think it will be a good time to buy. Properties are still in the recovery stage. You can find good properties at very good prices today,” GM Training Academy chief executive officer and founder of Michael Yeoh.

He said this is a good time for investors as the trend going forward is to buy properties and do short-term rentals which is giving a better return on investment than long-term rentals.

In short, savvy investors will be able to seek out good opportunities that are linked to the property market and given the current prices, the sum invested will be less than when the market fully recovers.

In the meanwhile, the observer said older properties in the sub-sale market are also offing good if not better deals. “For instance, the cost of a new development is typically more than that of the more established one next door. Choose a sub-sale home rather than a new one if the price difference between the old and new apartments is too great,” he said.

“The older homes have more potential for appreciation, particularly if the new, sexier development has a pulling effect on property values. However, it takes time. Taking Desa Park City as an example, people used to say - Oh, that's Kepong area - but the development has since become a sought-after address. Did you notice an increase in the value of the properties surrounding Desa Park City? They certainly went up,” he added.

Number of seniors buying high-rise apartments doubled

The pandemic has caused a twofold increase in the number of senior buyers of apartments in sizable, brand-new high-rise developments, compared to 2019 and developers are scrambling to respond to this new demand by increasing the accessible features in their projects and planning amenities that can be enjoyed by all ages.

“We have seen a doubling in the number of enquiries from retirees and elderly buyers at big high-rise projects. They used to make up only about 2% of Juwai IQI’s total enquiries in Malaysia, but their share is now about 5%,” said Juwai IQI co-founder and group chief executive officer Kashif Ansari said.

“If this demand keeps up, elderly-friendly projects could earn a price premium of 5% to 15% by 2025, compared to otherwise similar projects. Building for all ages is just good business. It increases the range of possible buyers and leads to more desirable homes and communities.

“The big five as you get older are community, nature, physical activity, accessibility, and financial security. Today’s new projects respond to all five of these requirements. Developers are offering wonderful lifestyles not just to singles and young families but also to retirees and the elderly.” he said, adding that Malaysia is ranked as the seventh-best country for retirees.

Ansari said architects are creating shared spaces that encourage social interactions to create a sense of community. Gardens, entertaining areas, roof terraces, and walking paths are configured so they can host multiple different types of activities. That increases the range of residents who use them and spend time together.

“Another aspect of the community is feeling secure. Apartment buildings offer much greater security and protection for seniors because you have neighbours and building staff close by at all hours and access is limited to residents and their guests,” he said.

Developers now include more natural elements such as park views, miniature parks, rooftop lawns, viewing platforms, Zen gardens, outdoor dining and barbecue areas, and outdoor spaces for exercise or picnicking. Such features appeal to the older generation who might have their own garden space but they also appeal to the younger generation as well. With such amenities, apartments offer an easy lifestyle to seniors.

More and more modern-designed apartments tend to have larger foyer areas and bathrooms to cater to wheelchairs as well as allow the elderly more freedom of movement. Notably, these larger spaces also appeal to non-senior buyers.

“The thing retirees worry about most is having enough money to support themselves throughout their old age. Owning your home gives you financial security and makes it easier to plan ahead.

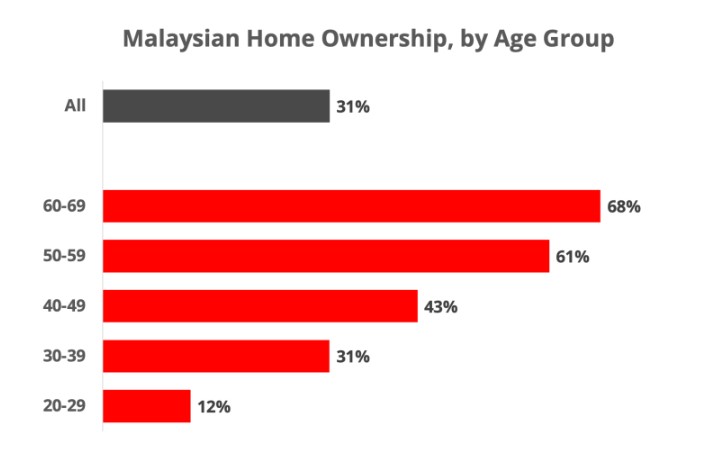

“Luckily, home ownership rates are 68% for those in their 60s and 61% for people in their 50s. By contrast, only 43% of people in their 40s own their homes. The rate for 30-somethings is 31%, and 20-somethings have a homeownership rate of 12%,” said Ansari.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.