Selangor sees a modest drop in property overhang in H1 2022

By Joseph Wong

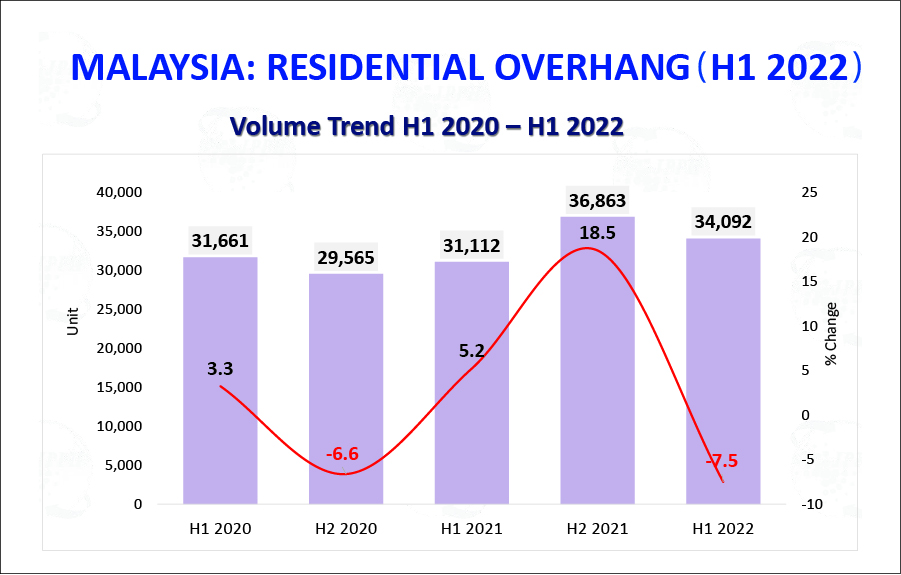

There are signs that the residential overhang is improving as the number has slipped to 34,092 units valued at RM21.73bil as per the first half of this year (H1 2022) compared to 5,5932 units in Q1 2022.

Last year, the volume of residential overhang reached an all-time high of 36,863 units valued at RM22.79bil, according to data from the National Property Information Centre (Napic).

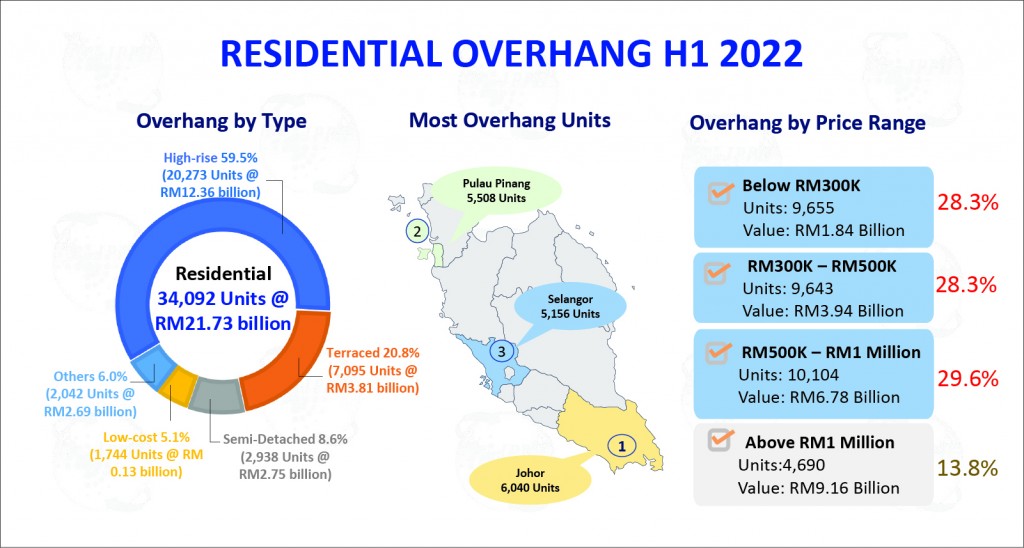

As of H1 2022, high-rise units still make up the biggest portion with 59.5% of the total residential overhang at 20,273 units. Terrace houses make the next biggest number at 20.8% with 7,095 units valued at RM3.81bil.

Semi-detached houses make up 8.6% with 2,938 units valued at RM2.75bil while low-cost homes stand at 5.1% with 1,744 units valued at RM130mil. The other property types form the remaining 6.0% with 2,042 units valued at RM2.69bil.

Last year, Selangor had the highest number and value of overhang with 6,095 units worth RM5.28bil. By Q1 2022, it fell to 5,215. The current overhang figure for Selangor is 5,156 units.

Johor, which had 6,089 overhang units worth RM4.72bil last year, saw a reduction in Q1 2022 at 5,992 units but the figure again increased to 6,040 units as per the H1 2022 data.

Penang also experienced a see-saw rise and fall of the overhang numbers. It stood at 5,493 overhang units valued at RM3.56bil as of 2021 but the unsold units rose to 5,816 in Q1 2022. A total of 292 units were sold during the three-month period so as of H1 2022, Penang has 5,508 overhang units.

There were also an equal number of overhang properties for those priced from RM500,001 to RM1mil (29.6%), RM300,001 to RM500,000 (28.3%) and below RM300,000 (28.3%).

In terms of value, the high-end properties, while they make up 13.8% of the total overhang, amount to RM9.16bil across 4,690 units. This is followed closely by properties priced at RM500,001 to RM1 million with 10,104 units valued at RM6.78bil.

Properties priced from RM300,001 to RM500,000 make up 9,643 units valued at RM3.94bil while those below RM300,000 comprise 9,655 units valued RM1.84bil respectively.

Fewer serviced apartments overhang

Selangor also saw a drop in the serviced apartments overhang as it slipped to 2,248 units. However, it is still the third highest compared to first place Johor with 15,423 units and Kuala Lumpur with 4,279 units.

The serviced apartment overhang grew from 21,683 units in H1 2020 to 23,606 units in H2 2020. It further increased to 24,064 units in H1 2021, peaking at 24,295 units in H2 2021 before dropping to 22,674 units in H1 2022.

A staggering 65.5% of the serviced apartment overhang consists of properties priced between RM500,001 and RM1 million. This comprises 14,851 units with a combined value of RM11.11bil.

This is followed by properties priced above RM1mil, making up 23.5% with a volume of 5,321 units and value of RM7.25bil. Serviced apartments priced from RM300,001 to RM500,000 make up 8.7% with 1,981 units valued at RM840mil, while those priced below RM300,000 only comprise 521units valued at RM120mil.

Incoming supply

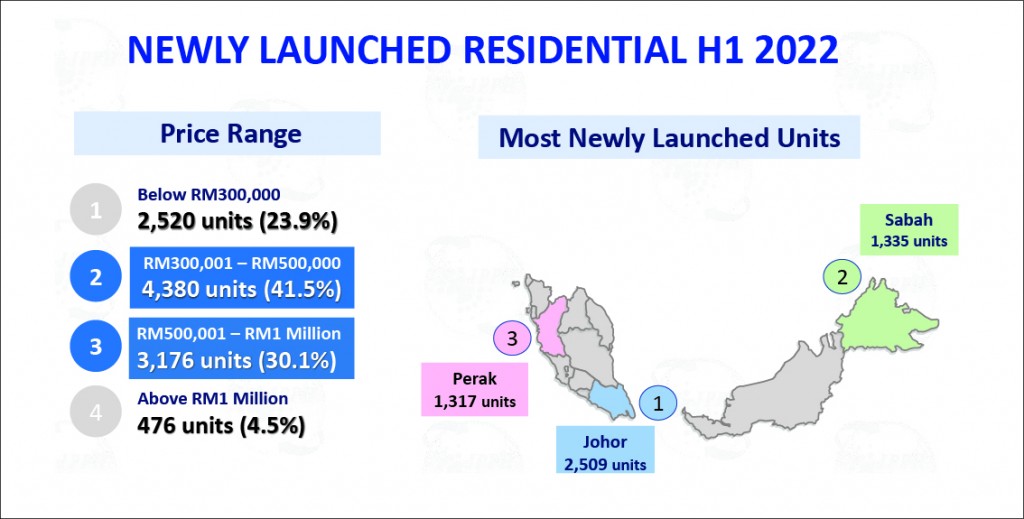

There were 10,552 units in residential new launches in H1 2022, of which only 2,141 units (20.3%) have been taken up. Of the total, 8,543 units are new landed properties and 2,009 units are high-rise apartments and condominiums.

Johor saw the most launches with 2,509 units, followed by Sabah with 1,335 units and Perak with 1,317 units.

Properties priced from RM300,001 to RM500,000 make up the bulk of the new launches with 4,380 units or 41.5% while properties priced from RM500,001 to RM1mil total 3,176 units or 30.1%.

This is followed by properties below RM300,000 at 23.9% , which amounts to 2,520 units and 476 units or 4.5% are those priced above RM1mil.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.