Receiving the MDA 2025 trophy from Housing and Local Government Ministry secretary-general Datuk Wira M Noor Azman Taib (second, from right) was KSL Holdings Bhd director Patrick Ku (second, from left) as Star Media Group chairman Tan Sri Wong Foon Meng (left) and FIABCI-Malaysia president Dr Yu Kee Su look on.

A solid foundation needs a sensible and reasonable approach

In the volatile landscape of the property market, true longevity demands more than just aggressive growth; it requires the ability to withstand and absorb significant economic shocks. This capacity for endurance, known technically as financial stability, is the bedrock of operational success. For businesses, poor resource management can quickly lead to crippling instability. Consequently, successful developers must possess the skill to manage their resources wisely, ensuring resilience is built into their core structure—a fundamental reason why financial stability is a crucial quantitative attribute in the Top-of-the-Chart (TOTC) Awards.

Financial stability, at the corporate level, hinges on demonstrating a sensible and reasonable approach to expansion and debt. A company’s future is determined by its competence in navigating turbulence. It must skillfully manage its capital and debt to continuously create value for stakeholders, positioning itself for long-term sustainability rather than short-term gains.

Balancing growth and prudence

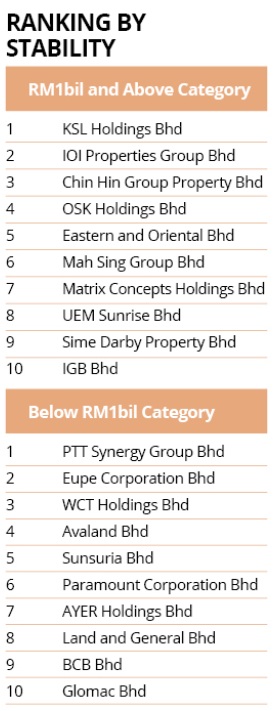

The stability attribute within the TOTC Rankings is specifically engineered to measure how effectively a developer expands its footprint while maintaining financial control. For the 2025 assessment, the methodology focused on two primary, intertwined indicators across the period of 2022 to 2024: the growth in total assets and the management of debt leverage.

Companies that demonstrated consistent, positive asset growth over the three-year period were heavily prioritised, signaling strong, effective utilisation of capital for expansion. Simultaneously, the evaluation scrutinises the debt-to-total-asset ratio. A low ratio is preferred, reflecting healthier and more prudent financial management. However, the system acknowledges that striking a balance is key: an excessively low ratio might indicate an underutilisation of resources, just as an excessively high ratio signals dangerous over-leverage. Both extremes can ultimately hinder a company’s operational capacity and potential for sustained growth.

Leaders in leverage management

In the RM1bil and above category, KSL Holdings Bhd emerged as the undisputed leader. KSL achieved a massive 67.85% growth in total assets over the three-year period, leaping from RM2.79bil to RM4.45bil. Crucially, they achieved this dramatic expansion while maintaining an averaged debt-to-total-asset ratio of just 6.3%. This performance showcases textbook financial prudence—the ability to grow rapidly and substantially without relying heavily on debt financing. Other notable performers who demonstrated consistent asset growth and sound financial management included IOI Properties Group Bhd and Chin Hin Group Property Bhd, securing second and third places, respectively.

In the below RM1bil category, PTT Synergy Group Bhd (PTT) claimed the top spot. PTT’s win was secured by posting three consecutive years of strong positive asset growth, a compelling sign of the company's successful undertakings and expansion. However, the evaluation noted an area requiring future attention: PTT’s averaged debt-to-total-asset ratio stood at 64.9% across the three years under review. While reflective of significant project commitment, this figure indicates a leverage level that warrants monitoring to ensure the preservation of long-term resilience.

Stability as the cornerstone of corporate value

In today’s persistently volatile market, cultivating financial resilience is the single most vital factor for business continuity. Stability is the bedrock upon which operational success is built, enabling companies to confidently navigate unforeseen challenges and ensure the long-term creation of value for all stakeholders. The TOTC Awards specifically recognises companies that not only expand their holdings but also skillfully manage their debt levels and resources. By rewarding those who have demonstrated solid financial foundations, the MDA cements the principle that true success is defined by the capacity for enduring, responsible growth.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development and lifestyle trends when you subscribe to our newsletter and follow us on social media.