The doors are opening again for the hotel industry.

Survey reveals many investors are considering increasing their exposure to the industry

By Yanika Liew

It has been over two years since the Covid-19 pandemic caused a massive global shutdown of the travel industry. After several false restarts, there is a renewed sense of optimism that 2022 will be the year of recovery, especially with many countries reopening their borders, including Malaysia.

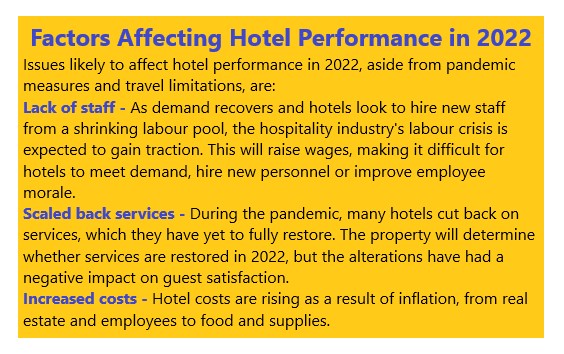

Along with the optimism, the hospitality industry’s stakeholders are already strategising travel trends, along with plans for hotels and lodging operators to overcome the obstacles and seize the opportunities.

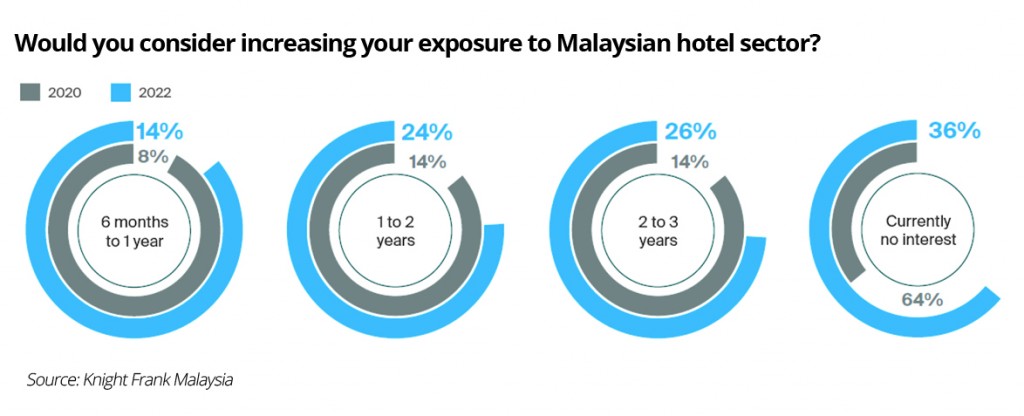

International property consultant Knight Frank Malaysia, having recently concluded its second Malaysian Hospitality Investment Intentions Survey, revealed that 64% of respondents are considering increasing their exposure to the Malaysian hotel sector, a sharp hike in comparison with 36% back in 2020.

On the opposite end of the pendulum, 36% of respondents are currently not interested in increasing their exposure in hotels but this is a significant drop compared to the 64% in 2020. This is a positive sign that sentiment towards the sector is returning.

The survey analysed the investment perspectives of hotel owners, operators and owner operators to draw a comparison with its earlier survey to compare how they have continued to be impacted by Covid-19 in Malaysia, the level of investment demand, investment preferences, and investor sentiment towards the sector.

Tumultuous years

“Given the last two tumultuous years, it is not surprising that investment in hotels across Malaysia fell from a 2017 high of RM2.2 billion to just RM556 million in 2020 and RM177 million in 2021,” said Knight Frank Malaysia capital markets executive director James Buckley.

“Since our first survey, we have seen a rapid and widespread distribution of Covid-19 vaccines globally, an increasing list of countries opening their borders to international travellers and airlines re-establishing some of their flight networks. International traveller’s confidence is slowly returning and this is filtering through to the 2022 survey with investor sentiment recovering. We do expect to see an increasing number of hotel transactions over the next 24 months,” he said.

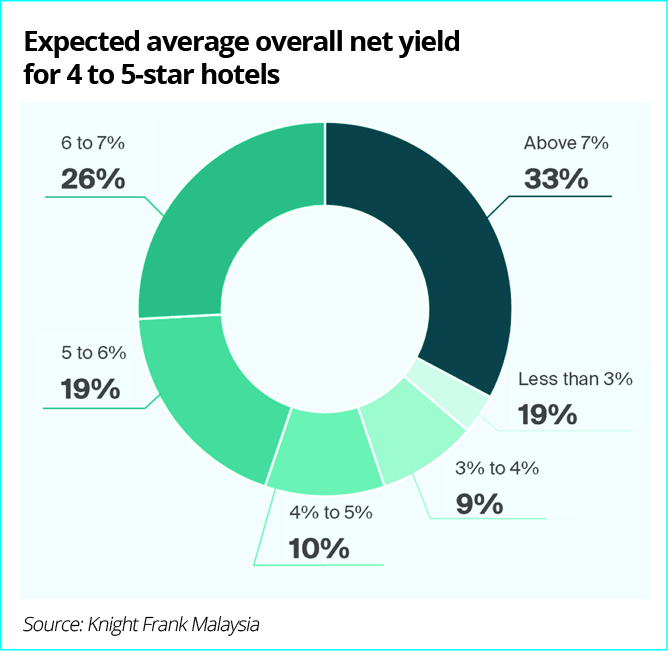

Investors continue to seek high returns to offset the risk of investing in the sector. 33% of respondents are targeting a net yield of above 7% (versus 36% in 2020) when acquiring a 4 to 5-star hotel in Malaysia. 26% of respondents are targeting net yields of 6-7% (versus 29% in 2020), whilst 19% would accept 5-6% (versus 29% in 2020).

“I think investors are seeing 2022 as a good time to invest in Malaysian hotels. They can see the economy is recovering, especially now that the borders have reopened. Many can see the strong pent-up demand for holiday travel and in the short term, Singapore tourists, coupled with domestic demand will drive hotel performance in 2022.

“We expect to see hotel transaction volumes increase in 2022 as the price gap between vendors and purchasers will narrow as investors become more optimistic with the border opening and increasing arrivals. Although bank financing of hotels has been quite difficult during the pandemic, banks will also see the improvements in the sector and begin to lend again,” said Buckley.

Historically, Malaysia has attracted a diverse pool of international tourists from all over the world and is particularly well-positioned to capture the growth of Halal Tourism. Malaysia ranked as the top destination out of 140 countries in the MasterCard CrescentRating Global Muslim Travel Index 2021 for being the most Muslim friendly holiday destination, beating Turkey, Saudi Arabia and Indonesia. Traditionally prime hotels do not come to market regularly and the next 12 months present a window of opportunity to acquire some unique opportunities.

The majority of the hotels have conservative levels of gearing. A total of 43% have less than 49% loan to value ratio whilst 17% have no debt at all. However, 31% have the loan to value ratio of between 50% and 69% and 9% have high gearing of above 70%. On a whole, hotel owners with conservative gearing have managed to weather the pandemic storm and have not had to sell at fire-sale prices.

“The survey indicates that owners of Malaysian hotels tend to have quite conservative levels of debt. Lower leveraged properties carry less risk and are better equipped to weather market fluctuations and might explain why we have not seen any notable distressed hotel sales during the covid-19 pandemic,” Buckley added.

International travel resumes

On the global front, the international tourism arrivals plunged by 73% in comparison to 2019, marking the worst year on record for tourism, according to the United Nations World Tourism Organisation (UNWTO). The numbers were only slightly better in 2021, with a modest increase of 4% over 2020.

Looking ahead to 2022, the path to recovery has been disrupted by the Omicron variant, which has spread like wildfire around the globe. According to the UNWTO, international tourist arrivals could grow by 30 to 78% in 2022 compared to 2021, but that’s still 50 to 63% below pre-pandemic levels. The majority of the UNWTO’s global panel of tourism experts, 63%, don’t expect global tourism to recover to 2019 levels until 2024 or later.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.