BY TEE LIN SAY

PETALING JAYA: Genting Malaysia Bhd (GenM) may have to write off an investment of US$274mil (RM1.18bil) should the US Department of Interior (DOI) effectively decide that construction of the First Light Resort & Casino (FLRC) in Massachusetts is not able to proceed.

A definite decision on this issue will be made by June 19, 2017.

The construction of the FLRC has ceased for a year due to reservation land issues.

GenM’s venture in Massachusetts started in April 2016. GenM announced then that it would manage the FLRC, a native American-destination resort casino in Massachusetts to be built by the Mashpee Wampanoag tribe.

GenM’s appointment as manager was expected to be for seven years starting from the opening of the 900-room resort casino in Taunton, in the state of Massachusetts.

The GenM group does not have any equity interest in the project, which is sovereign.

It has, however, invested US$274mil in interest bearing promissory notes issued by the Mashpee Wampanoag Tribal Gaming Authority for the initial development phase of the project.

GenM had said that the investment in notes allows the group to enhance the returns expected from its involvement in the project.

“GenM invested US$274mil, equivalent to 20 sen per share, in MW promissory notes that carry interest rates of 12% and 18% per annum,” said Maybank Investment analyst Yin Shao Yang in his report recently.

“If the new record-of-decisions (ROD) is unfavourable, we gather that GenM may write off the investment and forego net interest income of RM105mil. If the new ROD is favourable, we estimate that GenM will also earn management fees of some RM60mil per annum for seven years from 2019 and lift our target price by 14 sen a share,” said Yin.

Thus, he said, that if the outcome is unfavourable, his sum of parts (SOP) based target price may be trimmed by 20 sen per share. If the outcome is favourable, his target may instead get a 14 sen lift.

GenM closed 1 sen lower to RM5.80 last Friday. It is up some 28.35% on a year to date basis.

For now, Yin’s financial year (FY) ended Dec 31, 2017 to FY19 numbers are little changed and he has a hold call, with a 2% upward tweak to his SOP target price of RM5.40.

Going back to last year, when GenM was first appointed as manager, the DOI had already issued a ROD to hold Mashpee Wampanoag (MW) reservation land in trust under Category 2 of the Indian Reorganisation Act, which means: Tribe Living Continuously on an Existing Reservation.

This enabled the MW tribe to construct the FLRC. But on July 28, 2016, federal district court judge William G. Young ruled in favour of a group of Taunton residents who challenged the ROD. As a result, construction of the FLRC ceased.

Judge Young later ruled that the DOI could instead hold MW reservation land in trust under Category 1 – meaning that the tribe was federally recognised before 1934.

That said, the MW tribe was only federally recognised in 2007.

Hence, this matter will be settled by the DOI once and for all via the issuance of a new ROD by June 19.

“Currently, we assume that Genting Malaysia will not write off the investment, will earn interest income but still not earn management fees yet,” said Yin in the note.

In a Taunton Daily Gazette article dated March 15, MW Tribal Council chairman Cedric Cromwell was optimistic that Interior Secretary Ryan Zinke would do the right (thing) for the tribe.

While that could be the case, the Trump administration has also made about-turn decisions which were not to the American Indian’s interest.

For example in February, the Trump administration gave the final approval needed to complete the Dakota Access Pipeline. This decision was immediately decried by members of the Standing Rock Sioux tribe, including some members of the MW tribe.

They believe that the land in question belongs to them under treaties they signed with the US government in the 1800s.

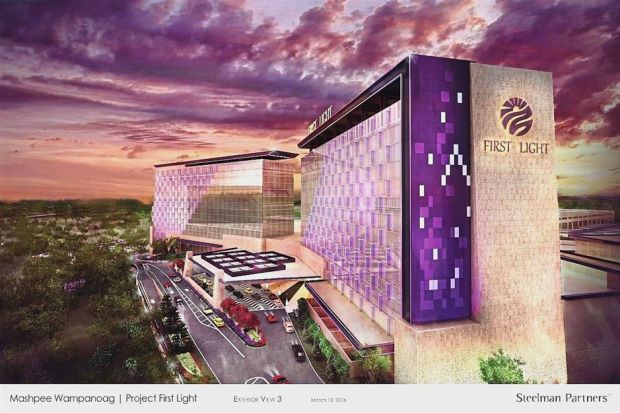

Nonetheless, should FLRC be completed, it will feature, among others, a high-concept 150,000 sq ft casino featuring 3,000 slots, 150 gaming tables and 40 poker tables.

There will also be a luxury hotel complete with spa, a large pool and meeting facilities; a mid-range hotel with a 15,000 sq ft convention centre and a 200-seater 24-hour restaurant; a family hotel consisting of a 25,000 sq ft indoor/outdoor water park; and retail shopping destinations and a food court plus restaurants.

The group’s foray into the gaming industry in Massachusetts is expected to complement and further establish its growing presence in the US, where it already has operations and developments in the states of New York and Florida.

The group also has a casino in Las Vegas but it is under Genting Bhd, the parent company.

Follow us on Wechat or Facebook for the latest updates.

Download StarProperty.my e-Mag(bit.ly/StarProperty_Emag) for more articles.

Want to contribute articles to StarProperty.my? Email editor@starproperty.my. [slider id='81590' name='StarProperty' size='full']