The recent Malaysian Hospitality Investment Intentions Survey conducted by global property consultant Knight Frank Malaysia reveals positive signs pertaining to the ailing hospitality industry that has been badly hit by the Covid-19 pandemic.

Almost half of the respondents remain positive about the hospitality sector outlook in the next 12 months, with 45% feeling that the sector is on its way to recovery, albeit contingent on the progressive roll-out of the vaccine and opening up of international travel restrictions. The survey analysed the investment perspectives of hotel owners, operators and owner-operators, providing insight on investment demand, investor preferences and pricing.

Moreover, the survey reveals that 14% of the respondents anticipate buying hotel assets within the next two years, while 16% look to make an acquisition even sooner within the next 6 months despite the pandemic. “Well capitalised, shrewd investors are looking beyond the pandemic and see this as an opportunity to acquire prime hotel assets at more reasonable pricing.

We believe prices for Malaysian hotels that trade will reflect a 10-30% discount from their pre-Covid values,” said Knight Frank Malaysia capital markets executive director James Buckley. In Southeast Asia, Malaysia is ranked 3rd as the most attractive country for hotel investment, after Thailand and Singapore. Several criteria were highlighted as important factors when choosing to set up a hotel operation in a country.

A total of 89% of the respondents indicated that tourist arrivals and flight accessibility are crucial in their investment decision-making process. This was followed by friendly government initiatives which play an important role in motivating hotel operations and investments as it cushions the impact of market sentiment. Buckley added: “Tourism is an important sector as it is the third largest contributor to the economy and employs about 3.6 million people. Before the pandemic hit, it contributed a total of RM86 billion in tourist receipts from about 26 million international visitors in 2019.

“Upgrading, expanding and improving direct international flights to Penang and Langkawi, in particular, would provide a real boost to tourism. Langkawi is a fantastic tourist destination with great potential to grow its international tourist arrivals and receipts and compete on the same footing as Phuket, Bali and the Maldives. To achieve this, it needs to improve its regional flight accessibility.”

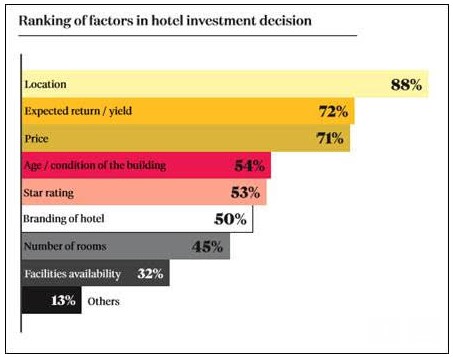

Location is considered the most important factor by respondents when investing in a hotel. The next factor considered by 72% of respondents was the expected returns. Many investors are now seeking higher returns to offset the risk of investing in the sector during the pandemic with 36% of respondents targeting a net yield of above 7%. As a consequence in 2020, the volume of hotel transactions across Malaysia fell by 36% compared to the 10-year annual average.

The availability of bank financing for hotel transactions has been significantly curtailed which has also played a factor. During these challenging times, investors are increasingly looking towards yield accretive assets, said Knight Frank Malaysia valuation and advisory executive director Justin Chee.

“As shown by the sentiment survey, the majority of respondents (36%) expect a net return of above 7% from the hotel asset class. It is important to note that based on the past few hotel transactions (in the past 5 years) hotels in Malaysia were generally transacted at net yields of about 4% to 6% and there is definitely a mismatch between the expected return and the selling prices of hotels,” he said.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.