BY HO WAH FOON

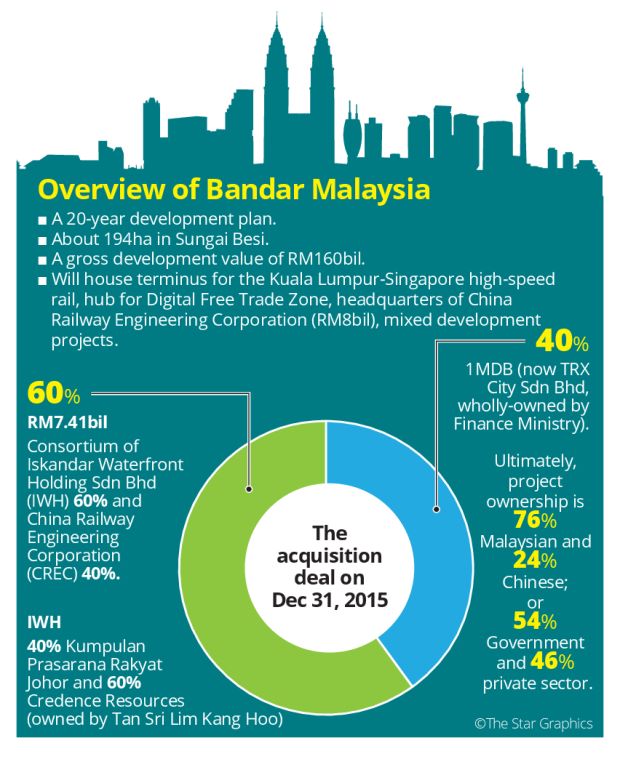

PETALING JAYA: The news on Wednesday that the Finance Ministry (MoF) has called off a deal to sell 60% of Bandar Malaysia – a mega property development project estimated to have a gross development value of RM160bil when completed in 20 years – has sent shockwaves through the country and the region.

This unexpected announcement attracted attention mainly because of the buyers involved, and the possible political and economic implications. It came so abruptly that Prime Minister Datuk Seri Najib Razak cancelled his official visit to the Bandar Malaysia site late Wednesday without giving notice to the media.

The buyers are Iskandar Waterfront Holdings Sdn Bhd (IWH) – owned by tycoon Tan Sri Lim Kang Hoo – and China Railway Engineering Corporation (CREC), controlled by the central government of China.

IWH and CREC jointly signed the deal to buy the 60% stake in Bandar Malaysia from 1Malaysia Development Bhd (1MDB) for RM7.41bil in December 2015. IWH would hold 60% of the venture, while CREC 40%.

TRX City Sdn Bhd of MoF said in a Wednesday statement that “the buyers failed to meet the payment obligations”.

TRX City was originally owned by 1MDB but MoF took control of it last year to restructure the balance sheet of the company.

On the surface, many would immediately conclude that the aborted deal could be another casualty of China’s current capital controls to curb the outflow of the yuan to stop China’s US$3 trillion (RM12.99 trillion) forex reserves from sinking further.

In the past three years, Beijing saw an outflow of US$1 trillion (RM4.33 trillion).

Last March, the Forest City project in Johor was hit when its investors from China were not allowed to remit payments for their purchases.

But the payment due to TRX from CREC is only several hundred million ringgit – an amount that will have minimal impact on China’s vast reserves.

Hence, there have to be other factors as well, even if capital controls is one tangible reason.

A source close to the negotiators tells The Star “there are huge discrepancies in expectations from two sides”.

“There were many differences in the detailed terms between the Chinese and MoF officers. The Chinese side has come out with a shopping list for Malaysia to fulfil, but Malaysian officers cannot commit to many of the proposed terms due to national interest and social reasons,” said the source.

“China said it had done its part in 2015 to help Malaysia overcome its financial problems during critical times. Now Malaysia must play its part to ensure the Chinese investment in Bandar Malaysia gets maximum returns,” added the source.

It is learnt that one of the demands from China is that Malaysia “must try its best” to help China win the high-speed rail (HSR) project linking Kuala Lumpur with Singapore, a venture estimated to cost around RM60bil.

The first tender for the HSR project will be called in the last quarter of this year. The Bandar Malaysia deal was seen as leverage for CREC to get the HSR contract, as Bandar Malaysia hosts the HSR terminus on the Malaysian side.

“The HSR project is only one of the elements. The other disagreements centred on the ownership and operation of the HSR terminus, and the macro design and concept for the development of Bandar Malaysia.

“Malaysian officers could not agree to proposals that the HSR be owned by China, as it will be against national interest to allow strategic assets to be owned by foreigners. But to the Chinese, you would have to sort these things out yourself,” said the source.

Since the mega project has come under public and political scrutiny, local officials feel they have to take into account the political and social sensitivities of the contract.

The Bandar Malaysia development, which will also include a hub for a digital free trade zone to spur the e-economy, will carry many catalysts to spur economic growth.

The Bandar Malaysia news came at the wrong time for the Prime Minister, who is scheduled to meet with China Premier Li Keqiang on May 13 to sign some deals, just before he attends the Belt and Road Summit in Beijing on May 14 and 15.

To rescue this aborted deal, political masters will have to be involved, though it is not known at this point whether Najib will use the opportunity to seek a political solution to the Bandar Malaysia sale.

If the deal could not be rescued, there will be doubt on the viability of Bandar Malaysia as a development project. To recap, CREC had in March 2016 announced it would invest up to RM8bil to build its regional headquarters in Bandar Malaysia. With the latest development, it may not be surprising if CREC decides to rescind its intent.

According to UOB Kay Hian, a Singapore-based investment firm, the latest development will lead to a “significant overcast” on overall market sentiment, IWH-linked stocks, perception on the reliability of government deals and extent of Chinese foreign direct investments in Malaysia.

Malaysia and China signed deals worth RM144bil last November, including the construction and financing of the East Coast Rail Link project said to cost RM55bil.

“This deal cancellation could reverse the strong year-to-date foreign equity inflow into Malaysia, and hence the ringgit’s recent uptrend,” said a special report by UOB Kay Hian yesterday, which also saw both the stock market and ringgit dented by news of the lapsed deal.

Related story:

Follow us on Wechat or Facebook for the latest updates.

Download StarProperty.my e-Mag(bit.ly/StarProperty_Emag) for more articles.

Want to contribute articles to StarProperty.my? Email editor@starproperty.my. [slider id='81590' name='StarProperty' size='full']