“We are encouraged by the outlook for Malaysia’s office market, particularly as multinational companies expand operations in Kuala Lumpur, attracted by the city’s competitive real estate costs and business-friendly climate," said Teh.

KUALA LUMPUR: The Asia-Pacific prime office rental market is showing signs of resilience, with rents stabilising in Q3 2024. According to Knight Frank’s Asia-Pacific Prime Office Rental Index, prime office rents declined by a marginal 0.1% quarter-on-quarter, a positive indicator that the market could be reaching a bottom. This trend is strongly supported by robust demand in key Indian markets, driven by offshoring activities and domestic business expansion.

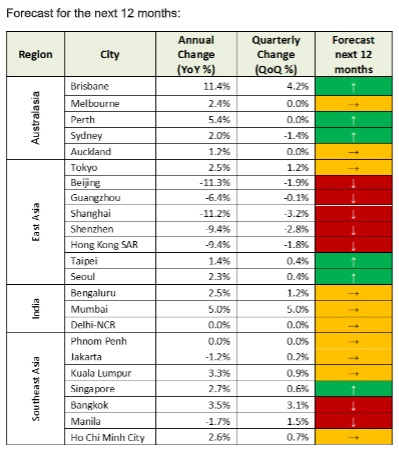

Knight Frank’s Q3 findings highlight a positive shift in rental growth and stability across the Asia-Pacific region:

- Sixteen out of 23 cities surveyed reported stable or increasing rents year-on-year, an improvement from 15 cities in Q2. Among the notable markets, Bangkok has seen rents climb back into positive growth territory.

- Year-on-year, regional rents saw a modest decline of 2.5%, slightly recovering from the 2.8% drop in Q2 2024.

- Leading rental growth, Brisbane saw an impressive 11.4% year-on-year increase.

- The primary drivers of rental decline remain in mainland Chinese cities, which posted an 11% year-on-year decrease, slightly steeper than the 10.6% drop in the previous quarter.

- Vacancies across the region showed a stabilising trend, dipping by 0.2 percentage points quarter-on-quarter to 14.8%, breaking a series of consecutive quarterly increases since Q2 2022.

Malaysia’s steady office market outlook

Knight Frank Malaysia office strategy and solutions executive director Teh Young Khean expressed optimism about the local office market. “We are encouraged by the outlook for Malaysia’s office market, particularly as multinational companies expand operations in Kuala Lumpur, attracted by the city’s competitive real estate costs and business-friendly climate. Despite higher vacancy rates across the Asia-Pacific region, Kuala Lumpur continues to show steady improvements in both occupancy and rental rates for prime-grade office spaces quarter-on-quarter,” he stated.

A shift towards compact spaces

Amidst cautious global economic conditions, companies are increasingly focused on cost efficiency, opting to renew leases and consolidate office footprints rather than expand. According to Knight Frank occupier strategy and solutions global head Tim Armstrong, the trend is toward smaller, high-density office spaces. “With global uncertainties persisting, occupiers are adjusting their capital expenditure, favouring renewals and consolidating office spaces. Where relocations do occur, companies are downsizing and opting for higher-density layouts, aligning with both cost-mitigation goals and the growing acceptance of hybrid work models,” Armstrong said.

He noted that although a shift in business sentiment may follow an easing of US Fed monetary policies, companies are expected to continue exercising spending caution, prioritising strategies that maximise space utilisation. As development activity peaks across the region, even a moderate rise in leasing activity could quickly tighten the availability of prime spaces. This would likely reinforce the flight-to-quality trend, where tenants look to upgrade to higher-standard buildings in an increasingly competitive market.

Future market dynamics

While the Asia-Pacific prime office market is expected to remain tenant-favorable through 2024, market conditions may shift in 2025. Knight Frank projects a 20% decrease in new supply next year, which could reduce space availability and make competition for prime office spaces more intense.

Knight Frank Asia-Pacific research head Christine Li explained: “Despite more than one million square metres of new supply, the regional vacancy rate dipped in the third quarter, marking the end of an eight-quarter trend of rising vacancies. The decline in rental rates also slowed to just 0.1% quarter-on-quarter, a sign that the market may be approaching stability. Strong demand from Indian cities continues to support overall rent levels, particularly as office supply slows. While tenants remain cautious, there is growing interest in new, high-quality spaces that emphasise sustainability.”

As demand grows for sustainable, modern office spaces and new supply slows, vacancy rates are likely to decrease gradually. However, Li cautioned that rental growth may stay muted in the near term, particularly as tech companies continue to right-size their headcounts and competition remains high in mainland China’s office market.

The Asia-Pacific prime office market’s signs of stability and resilience signal an adaptable environment, meeting demand for high-quality, sustainable spaces despite economic pressures. As the region transitions toward greater market balance, cities like Kuala Lumpur and Bengaluru emerge as promising office hubs, reflecting the region’s potential for long-term growth.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development and lifestyle trends when you subscribe to our newsletter and follow us on social media.