KUALA LUMPUR: Housing affordability, the overhang and the buy-or-rent dilemma found themselves at the forefront of the issues plaguing the Malaysian property market, each issue interlinked with the other, resulting in the unaffordability of real estate.

Real estate consultancy Rahim & Co International Sdn Bhd highlighted the issue of unaffordability in Malaysia’s recovering property market during a press conference on the Rahim & Co Research: Property Market Review 2022/2023 findings.

The conference was represented by Rahim & Co executive chairman Tan Sri Abdul Rahim Abdul Rahman, valuation director Chee Kok Thim, Estate Agency chief executive officer Siva Shanker, Petaling Jaya office director Choy Yue Kwong and research director Sulaiman Saheh.

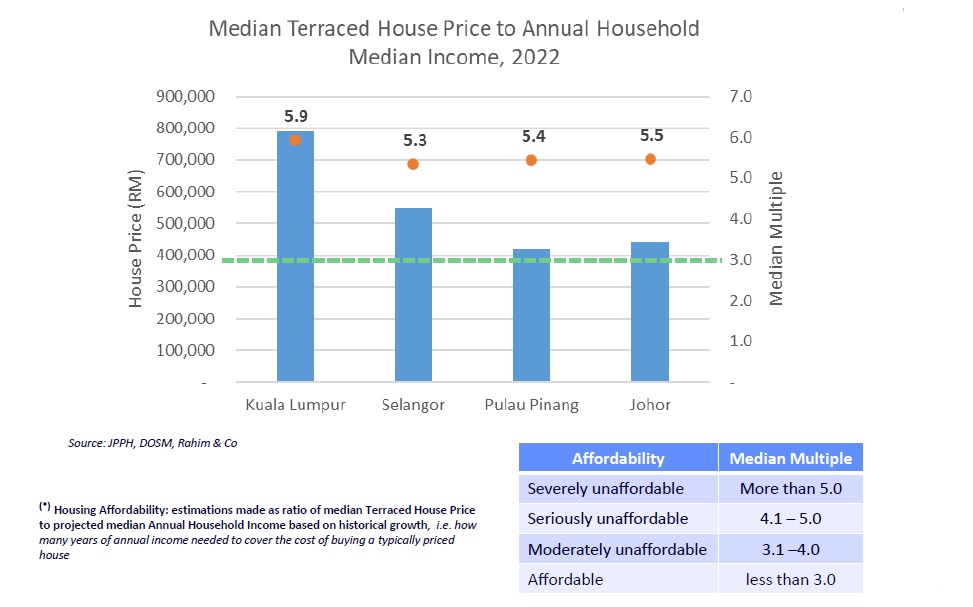

Rahim & Co highlighted Kuala Lumpur (KL), Selangor, Pulau Pinang and Johor as states with a significant mismatch of housing affordability. Comparing the median terraced house price to annual household median income, KL scored a 5.9, Selangor a 5.3, Pinang a 5.4 and Johor a 5.5.

Within Rahim & Co’s affordability metric, any number above 5.0 is considered seriously unaffordable.

“What does 5.9 mean? That means for 5.9 years, a person who earns and lives in KL will have to save every single cent of their gross income, not paying taxes, not buying food, for 5.9 years before they can equate to the median house price in KL, which actually causes the next issue, the overhang numbers,” Saheh said.

He cited affordability as one of the causes inducing overhang. In the third quarter of 2022, a majority of the overhang properties came from high-rise units. However, there was also the issue of overhang in lower-priced properties, albeit at a smaller number. Saheh pointed to other factors that may cause such an issue in so-called affordable housing, such as location or market demand.

Johor still accounts for the lion's share of the total overhang number, followed by KL and Selangor, which account for 17% and 14% respectively.

According to Petaling Jaya office director Choy Yue Kwong, Malaysia’s decentralised approach to affordable housing is partially to blame. He pointed to the Housing and Development Board in Singapore, which was a centralised body governing public and affordable housing. The body encompasses land planning, design, construction and maintenance, which can be very efficiently done.

In comparison, there is a multitude of bodies in Malaysia governing the supply of affordable housing.

“The problem with us is [that] land is a state matter and we have 13 states. All land matter is state matter. We have a Ministry of Housing but they can only advise the state, and cannot force the state to do things,” Rahim said.

“We have to overcome this. [Right now], each state must consider its own problem on housing, which is going to be very difficult,” he added.

2022 lookback and 2023 prospects

“Transactions in 2022 have proven the market to be somewhat resilient showing a significant rebound in market activities. This does not mean full recovery but more of a sign it is resuming the rebound trend interrupted by the pandemic and other domestic factors on our shores. Looking forward to 2023, we are cautiously optimistic about the year's prospects,” Rahim said.

The residential sector continued positive growth in transaction performance, with a majority of sales in the secondary market and only 18.5% in the primary.

With support such as the Malaysian Home Ownership Initiative (i-MILIKI) and the Real Estate Gains Tax (RPGT), the residential sector is expected to be stable in the coming months with gradual growth. The sector will also see developers taking a more passive approach to hedge against rising prices and economic uncertainty, with the hope that the Budget 2023 will be supportive to the sector.

Within the commercial sector, demand by consumers has been normalising for most of the year despite rising inflation. The office market continues to be a saturated environment of high supply with stagnant rental demand, urged on by the growing trend in decentralised locations and hybrid working. However, there has been an interest seen in older buildings going through asset enhancement exercises or even repurposing.

The hotel sector was the hardest hit and is anticipated to take a longer period to regain itself to pre-pandemic levels, aided by a rebound in tourism activities

The industrial sector maintained a positive growth, with a total net foreign direct investment inflow of RM54bil for the first nine months of 2022, in comparison to 2021’s RM29.7bil. It is expected to continue its place in the spotlight with emergent factors such as modern, built-to-suit facilities equipped with ESG (environmental, sustainable and governance) elements, keeping with the demands of global industry players and investors.

Overall, the review reported that the property market saw more progress in its recovery than setbacks, anticipating a stable path to gradual full recovery. This is in line with other countries, as positive growth had also been observed internationally.

“I hope this report will provide readers with some insight into the performances and happenings of the various property sectors. We hope this issue will assist you in making the right decision,” Rahim said.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.