KUALA LUMPUR: Increased domestic demand, better employment conditions, tourism and construction activity bolstered the Malaysian economy by 3.9% in the third quarter of 2023, property consultancy Knight Frank Malaysia reported.

Despite a decrease in the supply of residential properties, the market improved in the first nine months of 2023, with both transaction volume and value registering a year-on-year (YoY) growth of 1.3% and 3.5% respectively.

The report noted that developers have been doing their part in encouraging homeownership through collaborations with banks, as well as post-sale services, rental programmes and home care services.

“Despite the inflationary pressures and elevated OPR (Overnight Policy Rate), the residential property market appears to be moving in a positive direction, marked by increased sales volume, new property launches and successful completions,” Knight Frank Malaysia research and consultancy senior executive director Judy Ong said.

She pointed out that this was further supported by the government’s initiatives and incentives to encourage homeownership and the relaxed criteria for the MM2H Programme.

Knight Frank Property Hub managing director Enoch Khoo highlighted that the imposition of a flat 4.0% stamp duty on Memorandum of Transfer (MOT) for non-citizens and foreign-owned companies, effective from January 1, 2024, could greatly contribute to the control of property prices.

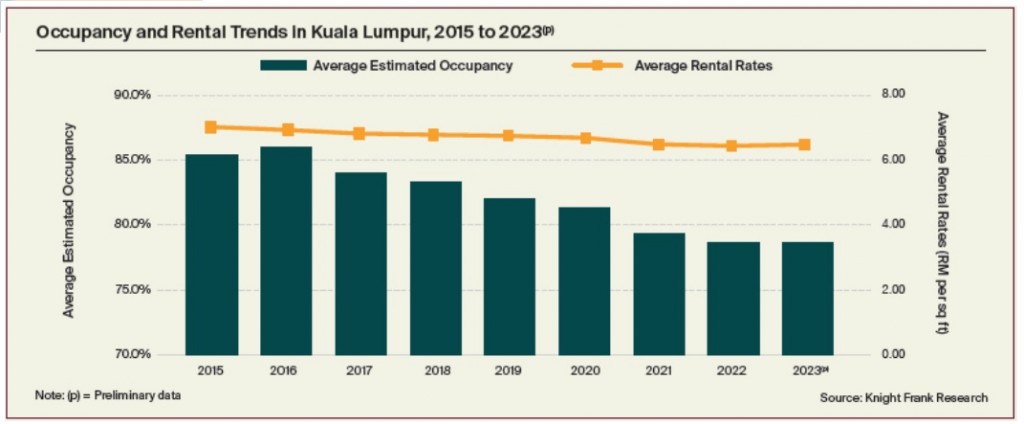

During the review period, Klang Valley recorded the completion of four new office developments, collectively adding an estimated three million sq ft of leasable space to the market. The KL City sub-office market continues to face increased pressure due to continued supply-demand imbalance, while the office markets in KL Fringe and Selangor exhibit resilience, characterised by steady leasing activities, particularly in prime locations featuring Grade A buildings.

In the second quarter of 2023, Malaysia’s retail sales fell below market expectations, contracting 4% YoY. The decline is attributed to consumers’ weakening spending power amid elevated inflation.

The restructuring of subsidies as well as changes in the Sales and Service Tax (SST), from 6% to 8% from 1st March 2024, alongside a 5% to 10% luxury tax, may discourage growth in the retail market. This could lead to rising operational costs, and subsequently, price adjustments, Knight Frank Malaysia property management director Yuen May Chee said.

With the uncertainty in the retail market, the government has allocated RM200mil for the ongoing Payung Rahmah initiative, which had been RM10bil in the previous year, to boost consumer spending.

When it comes to the industrial sector, the first nine months saw a higher sales value of 7.6% with a lower transaction volume of an estimated 4.6% on an annual comparison, indicating a relatively stable industrial sector.

“The ongoing geopolitical tensions, including trade disputes between the United States and China, conflicts between Russia and Ukraine, and the outbreak of military conflict in the Middle East, appeared to have affected Malaysia’s overall growth. Investors continue to be on their toes, staying cautious. The upcoming elections, particularly the presidential elections in the United States, Indonesia, and Taiwan may impact the development of economies in the region and certain investment or new development decisions may be deferred,” Knight Frank Malaysia land and industrial solutions executive director Allan Sim said.

While the global supply chain is still recovering from the effects of the pandemic, as well as current geopolitical conflicts, Southeast Asia emerges as one of the favoured relocation destinations due to access to raw materials, cost advantage, availability of skilled labour, political stability, market population, and economic growth, amongst others, Sim said.

The government will be deploying more resources into the country’s economy, as seen through its recently launched national Central Database Hub (PADU).

In addition, Knight Frank Malaysia expects a positive outlook for the country’s FDI due to the incoming king, Sultan Ibrahim Sultan Iskandar, as evidenced by the growth in the Johor real estate investment landscape over the past decade.

“We believe with the shift in the global landscape and the country’s latest strategic vision, we foresee a similar trend in 2024, where the industrial landscape will continue to anchor the real estate scene at a moderate pace,” Sim added.

When it comes to the 2024 outlook, Knight Frank Malaysia group managing director Keith Ooi notes that continued economic growth, domestic demand, recovery in the tourism sector and increased investment activity are expected to increase economic growth. These factors will be further supported by the initiatives outlined in Budget 2024.

Knight Frank Malaysia released its Real Estate Highlights 2nd Half of 2023 into the performance of property markets across Klang Valley, Penang, Johor Bahru and Kota Kinabalu.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.