IT is obvious that IOI Properties Group Bhd (IOIPG) was determined and focused in its bid for the Central Boulevard land in Singapore’s Marina Bay area.

It is also “understandable” that the deal raised quite a few eyebrows among shareholders and other parties given its record high quantum for a government land sale site and that it paid 16.29% higher than the second top bidder.

At S$2.57bil (RM7.77bil) for the 99-year leasehold of 2.69 acres, this translates into S$1,689 per sq ft per plot ratio (psfppr).

Singapore-based SLP International Property Consultants Pte Ltd executive director David Neubronner says it is easy to be critical but it is important to consider the broader global scenario, the oversupply situation in Malaysia and Singapore’s office sector.

There is an oversupply of office, mail, condominium, hotel space in Malaysia. This may explain why IOIPG sees better growth scope in Singapore.

That being the case, is office market, like any other segments on the island, is also under pressure as a result of the current global economic meltdown. Prime office rents have declined and an over supply market is not helping.

“IOIPG is (seen as) capitalising on a window opportunity, not in terms of capital value but in the supply cycle anticipated in the period 2019 to 2021 when the new office block is expected to be completed.

“But their reasons (for the purchase) can be compelling if we view it from the geo-political perspectives, the push and pull factors,” he says.

Neubronner explains that in Malaysia, mainland Chinese “are crowding and pricing out the big boys from their key playgrounds.” Oversupply in office retail and high end residential is a big concern.

“Hence, the need to constantly search and seek new markets,” he says. There is the pull factors with London, Melbourne and Singapore being favourite overseas markets among Malaysian property giants.

“A number of them are making their mark globally. Singapore always has the edge given the proximity, familiarity and strong Singapore Dollar,” he says.

Neubronner says although IOIPG paid a hefty premium over the next bidder, they were competing with the likes of regional giants like Capitaland, Hongkong Land and Temasek’s Mapletree.

[slider id='81590' name='StarProperty' size='full']

“This is a trophy site and a premium is to be expected,” he says, adding that the top three bidders had put in a bid price above the price last achieved at an adjacent site nearly 10 years ago. All seven bade way above market expectations, he says.

Neubronner says shareholders interest do not necessary align with the group’s medium to long term vision. The IOI brand is an “old bird” in Singapore and its ability to manoeuvre around the minefield of the Singapore market cannot be underestimated.

In a Bursa statement, IOIPG says the purchase is an opportunity to venture into prime office space with complementary mixed-use development in Singapore’s CBD area. The purchase will be an attractive addition to its investment portfolio and will contribute to future revenue stream.

IOIPG’s other projects are mainly high-rise residentials and include Seascape at Sentosa Cove, Southbeach Development (190 units - none sold), The Trilinq at Jalan Lempeng (60% sold, estimated 460 out of 755 units), Cape Royale at Sentosa Cove (for rent only) and Cityscape at Farrer Park (75% sold, estimated 190 out of 250).

Neubronner says IOIPG’s residential sales is in line with local market sentiments.

Mass and city fringe projects like Triling and Cityscape have enjoyed some success while the high end developments like Seacape and Cape Royale have suffered like all luxury developments due to draconian tax structures and borrowings measures imposed on foreigners and investors.

“Unsold residential units may be a blessing in disguise given the rapid rise of the Sing dollar against the ringgit in recent years,” he says.

As for this current purchase, what it plans to build on it have yet to finalise. Total development cost is expected to exceed S$3bil, Neubronner says.

This global meltdown, unlike the last one in 2009, is expected to weigh down on the office market for a while. Weak sales volume and rentals will persist. Yet, many are looking for bargains like the ones concluded during the Lehman crisis back in 2009 (but they) will be disappointed as capital values of prime property asset remain resilient.

Strong fundamentals in terms of liquidity and Singapore’s long term economic and political stability is the pillar confidence, says Neubronner. Singapore-based Jones Lang LaSalle (JLL) head of research Chua Yang Liang concurs.

The number of bids received - seven and more than the two to three bids for Asia Square Tower 1 and 2 in 2007 - and the prices submitted is a reflection of developers’ and investors’ confidence. It is two less than the nine received for the Marina Bay Financial Centre site back in 2005, says Chua.

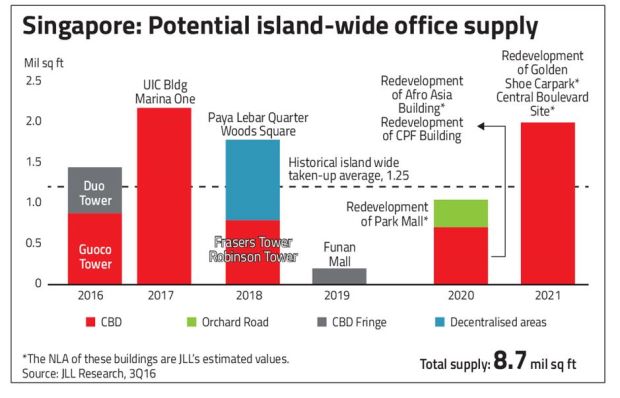

There is no office space shortage in the immediate term, with the completion of Marina One in 2017. However, the downtown office market will not have any major completion till 2020.

“In other words, with forecasted economic recovery in 2018, we should expect office demand to regain strength over that period.

“The supply overhang from Marina One’s completion will carry us through to 2019. With no major completions expected in 2020 except for the redevelopment of CPF building and Parkmall in Orchard, the expected completion of Central Boulevard by 2021 would dovetail nicely with the local market dynamics. This is possibly one of the key considerations that parties to the tender considered.”

Scepticism about IOIPG’s purchase could be due to the company’s previous deal on Sentosa Island which it jointly bidded with Ho Bee in January 2008 for S$1.1bil, or S$1,822 psf ppr.

The Global Financial Crisis the same year was a hurdle. When it finally launched the development, sales were not good. Neubronner said the deal was perceived as good value then.

“Unfortunately, the crisis happened and government measures to curb speculations followed. Sales were put on hold and the development, now Cape Royale, is available only for rent,” says Neubronner.

IOIPG recorded revenue and profit before taxation (PBT) of RM899.5mil and RM289.5mil respectively for the first quarter ended Sept 30, 2016. Revenue is RM304.3mil, or 51% higher and PBT is RM81.2mil or 39% higher than the preceding year corresponding quarter.

Its property development segment contributed revenue of RM793.6mil in the current quarter, an increase of RM291.4mil or 58% compared to the preceding year corresponding quarter.

The increase in both revenues is mainly from higher sales take-up rates for overseas projects in both Singapore and Xiamen, China and projects in IOI Resort City Putrajaya and Warisan Puteri @ Sepang.