BY NG PAU LING

PETALING JAYA: The residential overhang in Malaysia was at the “worrying” level, said Rahim & Co executive chairman Tan Sri Abdul Rahim Abdul Rahman in the Rahim & Co Seminar 2018 themed “The Malaysian Property Market: Where Are We Heading Post-GE 14?”

As announced by the National Property Information Centre (Napic) earlier, the number of residential overhang in the first half of 2018 (1H2018) stood at 29,227 with the value of RM17.24bil.

The Napic’s residential overhang figure excluded residential units built on commercial land such as serviced apartment, Soho, Sovo and Sofo units.

However, based on the Rahim & Co’s research, the overhang situation is even worse if the completed yet unsold units of the “commercial-titled residential property” are taken into consideration.

In the presentation by Rahim & Co research director Sr. Sulaiman Akhmady Saheh, the residential overhang recorded a higher number of 41,999 units worth RM26.84bil at 1H2018 including serviced apartment and Soho. Majority of the overhang units are found in Johor (32.6%), followed by Selangor (16.5%).

Johor recorded 13,691 overhang units worth RM9.82bil, an increase from 8,320 units in 2017. In Selangor, the overhang number stood at 6,909 worth RM5.34bil. Besides, other states with high overhang rate including Kuala Lumpur (4,791) and Penang (4,142).

Among all housing types, the number of overhang in the serviced apartment segment is on the rise and currently represents the highest number of overhang unit-type nationwide.

From the price perspective, upon the inclusion of the Soho and serviced apartment, the residential within the price bracket below RM500,000 represented half of the total overhang units. Meanwhile, there are 61% of overhang units priced below RM500,000 excluding the serviced apartment and Soho.

The survey attributed the market slump to low housing affordability, while the increasing house price and housing cost burden are the key factors leading to low affordability rating.

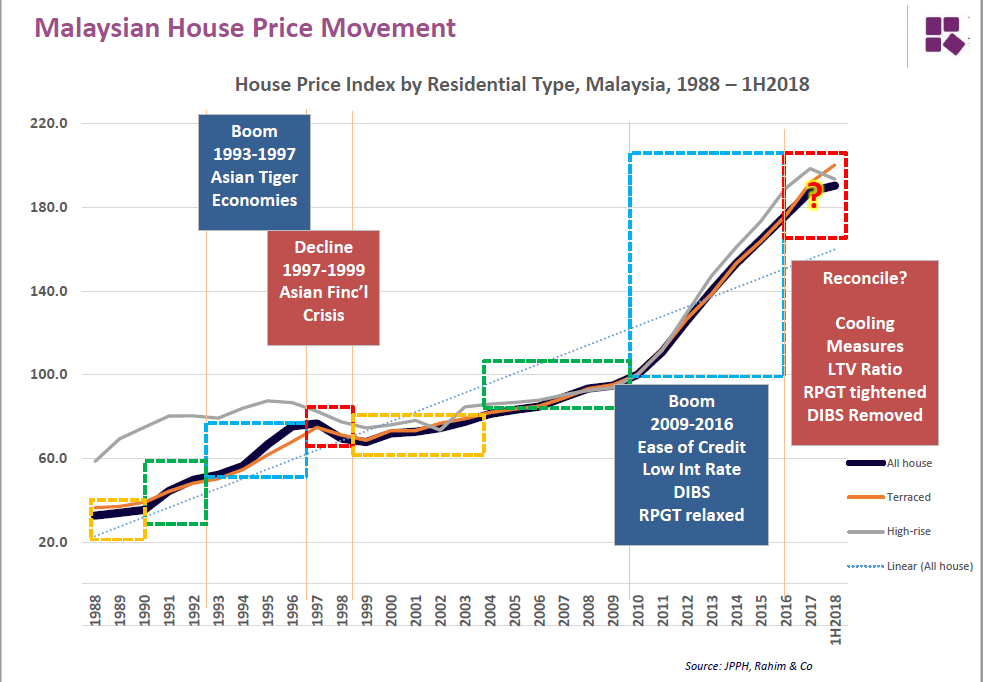

The data also showed that Malaysia’s property price spiked significantly between 2009 and 2016, and the company defined it as the “booming period” — where the house price hikes persistently due to the ease in credit access, low-interest rate, the available of DIBS and the RPGT relaxing period.

However, the household income growth is not in sync with the house price growth during the period. The stringent housing policies and the mismatch in product pricing eventually lead to the current unaffordable housing situation.

Given that the Malaysian median household income of RM5,228, the housing within the affordable price range should be at RM188,000, based on the median multiple approach.

However, in 1H2018, only 29% of the new launches were priced below RM250,000, and this has contributed to the rising overhang numbers.

Separately, in the press conference, Abdul Rahim said that the current housing market is not a recession, but just an oversupply problem, and he expects the overhang issue to improve in the next two years.

Rahim & Co real estate agency director Robert Ang concurred the statement by adding that there is no need for artificial control on the local property market.

“Malaysia is a mature economy, just let the market forces to decide the direction, the housing market will eventually balance and sought itself out,” said Ang.