By Joseph Wong

The Home Ownership Campaign (HOC), which ran throughout 2019, has been reintroduced to support particularly first-time homebuyers looking to purchase property and encouraged the sales of unsold properties in Malaysia’s housing market.

Dubbed HOC2, industry stakeholders are optimistic that the campaign will resuscitate the property industry, especially with the additional incentives given by the Economic Recovery Plan (Penjana).

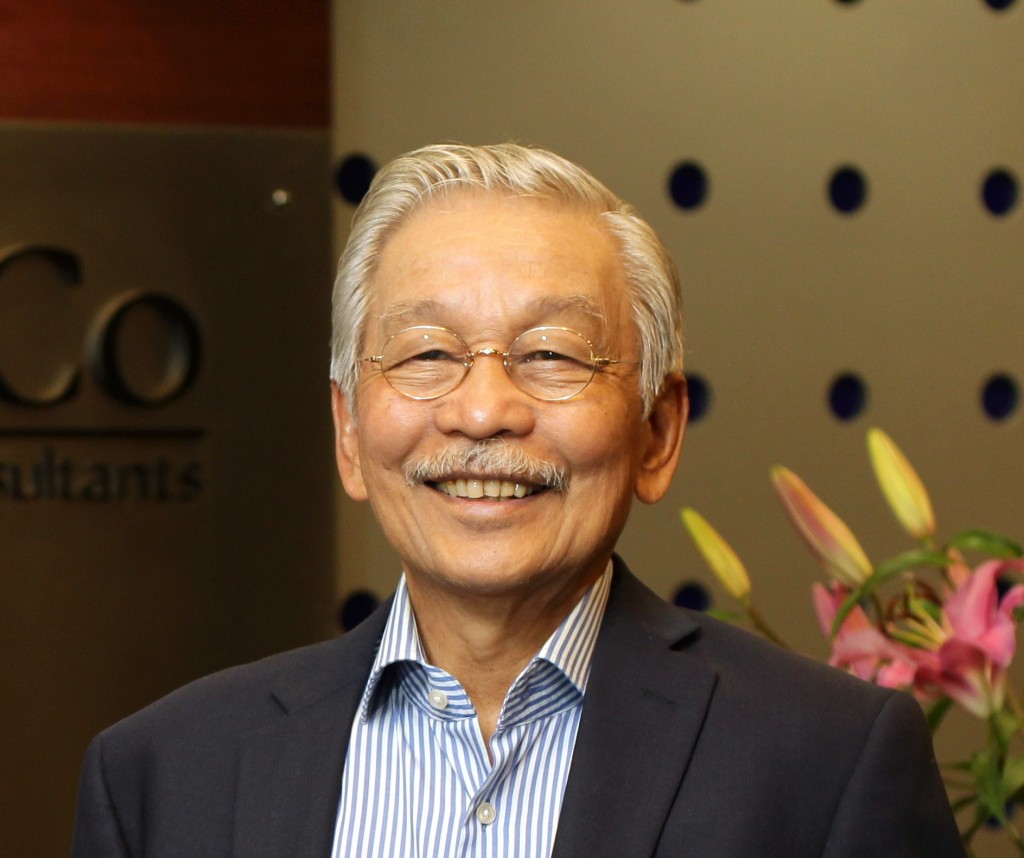

“We expect a similar set of benefits and deals as last year’s campaign: Stamp duty exemption on instrument of transfer for the first RM1 million, stamp duty exemption on instrument of the loan agreement; and mandatory discount of 10% by the developers of property sales made within the campaign period,” said Rahim & Co International Sdn Bhd executive chairman Abdul Rahim Abdul Rahman.

“However, we are still waiting for further details to be announced. Just to note, we wish that some of the stamp duty exemption benefits would also be extended to the secondary market to spread wider benefits to the rakyat,” he said.

The campaign period runs from June 1, 2020 to May 31, 2021 and among the expected to be the same as the 2019 version.

However, the impact could be somewhat different due to the different market environments between the two campaign periods. With the pandemic-forced movement control order (MCO) periods disrupting the economy and unemployment rates on the rise as a result of retrenchments, it is harder to predict the outcome of HOC2.

RMCO phase

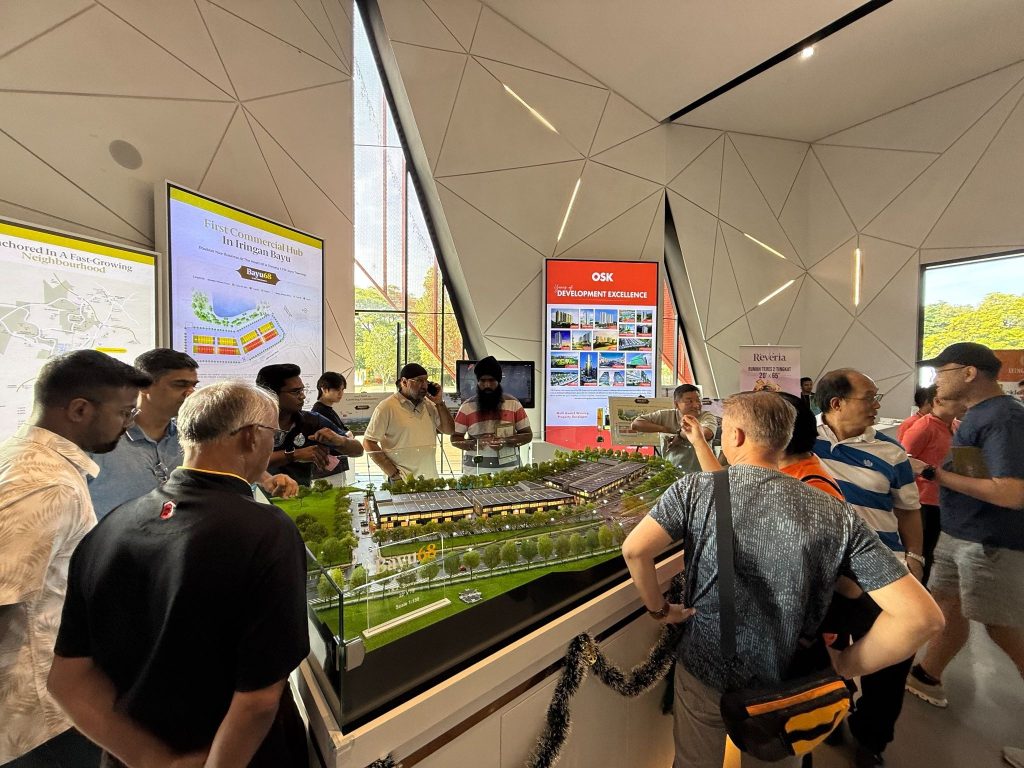

“As Malaysia is still in the Recovery MCO phase, the impact of HOC this year will be different. How will home expos be organised, for example, and would people come in droves for fear of a second wave?

“The impact will depend on how effective and sufficient the incentives will be to a Covid-19 ridden target market. A new form of marketing communication and interaction through technology like virtual expos, and the use of virtual reality and augmented reality technologies will be key to closing sales, on top of the other obvious product-centric factors,” said Abdul Rahim.

Another perspective to compare the level of impact is based on what objectives are set for the initiatives, he said, adding that HOC1 was aimed to reduce the overhang burden that had been plaguing the country since 2016.

“To this effect, we did see a significant slowdown in growth rate of overhang units by end 2019: Dropping from an annual increase of 42% to 63% between 2016 and 2018 to just a 10% increase in 2019,” said Abdul Rahim.

Developers happy

Meanwhile, property developers are rejoicing as they have been advocating for the return of the HOC.

Mah Sing Group Bhd founder and group managing director Tan Sri Leong Hoy Kum said the property friendly incentives announced are timely and much needed.

“The reintroduction of the Home Ownership Campaign is particularly appreciated as we secured 60% of our sales in 2019 from the previous HOC campaign. This bodes well for us to work towards achieving our 2020 sales target of RM1.6 billion.

“The stamp duty exemption and the uplift of 70% margin of financing limit for the third housing loan onwards during the HOC period, along with the Real Property Gains Tax exemption would certainly benefit Mah Sing as our product mix echoes the government’s policies and in line with market demand,” he said.

Similarly, LBS Bina Group Bhd (LBS) group managing director Tan Sri Lim Hock San was similarly happy, welcoming the government’s measures to stimulate the property sector through Penjana and HOC2. Click on this link to find out how the HOC2 can benefit developers.

“We are elated with the latest announcement on the incentive for the property sector as these incentives can spur the property market during this pandemic. We believe that the reintroduction of HOC is timely and will complement the LBS #DudukRumah Deals Campaign.

“With this in mind, we will be unveiling additional incentive package through the LBS #DudukRumah Deals to help Malaysians own a home,” she said.

With HOC2, the objective given for now is “to stimulate the property market and provide financial relief to home buyers”, he added. However, there is a “but” clause.

“We do not think the scope of HOC2 alone is wide enough to boost the entire property market and have it only to go up from here on out. Instead, we wish for HOC2 to expand its criteria to include the secondary market – a market that traditionally accounts for 70% to 80% of total residential transactions - where buyers can also enjoy similar stamp duty exemptions,” Abdul Rahim explained.

“The HOC2 is an intervention by the government to stimulate a market that is lagging even more from the unexpected downturn. While it does lend a hand to lessening the current overhang stock that had just been piling up over the years and inflating the slower sales performance, it alone is not sufficient to ultimately solve the problem from recurring in the future,” he said.

Contrary to popular perception, the HOC2 is not a quick fix solution for the property market. This would require intensive efforts not only from a few quarters.

Firstly, the production side of the market whereby the inflow of supply must match the demand based on a thorough and comprehensive development study. Secondly, the regulations or authorities side need to play proactive roles and thirdly, from the demand side as well.

“The fundamental problem of supply and demand mismatch remains, especially on the pricing angle, which is due to increasing costs, versus the degree of affordability due to lagging disposable income levels. Cost-driven pricing has to be re-assessed, although suppliers’ and manufacturers’ cost are rather sticky,” said Abdul Rahim.

Despite many are seeing headlines of discounts, the question remains: Is it genuinely affordable or artificially affordable?

At present, there is still a gap to be filled between house prices and disposable income levels, and the balancing task against the profits to not just the developer but also the suppliers, contractors and the financiers that need to be addressed.

And at the end of the day, it remains to be seen how effective HOC2 will be.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.