By Joseph Wong

A dynamic shift in wealth strategies adopted by Malaysia's newest and largest demographic cohorts, namely Generations Y and Z (Gen Y and Gen Z), is causing a fundamental and sustained transformation within the nation's real estate and property development sectors.

This evolution moves decisively away from the traditional, status-driven aspirations of previous generations, focusing instead on financial autonomy, flexibility and experiential living. This profound change was the central topic of discussion at the recent Juwai IQI International Summit 2025, providing developers, financiers and real estate professionals with a crucial roadmap for future market demand.

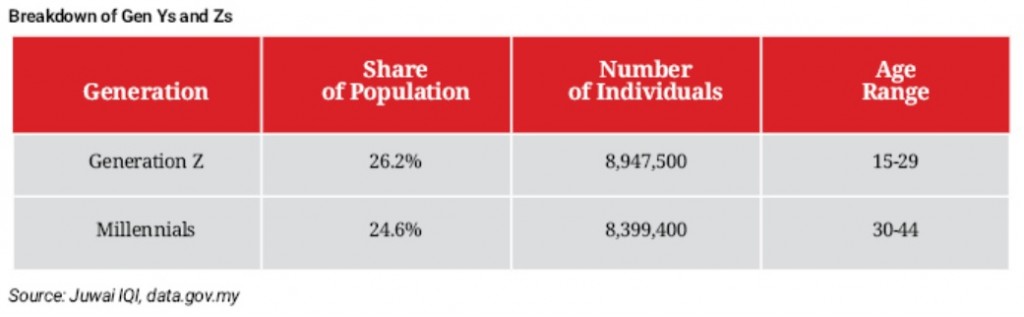

According to Juwai IQI co-founder and group chief executive officer Kashif Ansari, these two generations, who now account for over half of Malaysia's total population, are not merely adapting to existing market conditions; they are actively dictating a new set of rules for property investment and homeownership.

"The way that these two generations approach wealth is already profoundly changing society," stated Ansari, emphasising the inevitability of this market redirection.

The financial foundation

A cornerstone of the emerging wealth strategy for Gen Y, also known as Millennials, and Gen Z is their discipline in starting to save and invest earlier in life compared to the Boomers and Gen X. This behaviour is rooted in a palpable financial insecurity driven by awareness of economic unpredictability, yet paradoxically, it provides them with a stronger, earlier entry point into the property ladder.

Global surveys, including data pertinent to Malaysia, show that a significant portion of both generations (nearly half) do not feel financially secure, primarily worrying about the cost of living more than crime or unemployment. However, this anxiety has been channelled into proactive savings habits.

"Many of us have seen how unpredictable the economy can be, so we try to plan ahead and make smarter financial decisions," explained Jia Yin, a high-performing Gen Z agent on the IQI Elite Team. This foresight manifests in a greater openness to exploring diverse financial avenues, critically including investing in property or exploring digital finance.

Risk appetite and the generational divide

While both generations are proactive, their risk profiles differ, influencing their initial property choices. For Gen Z, aged between 15 and 29, their basic needs are usually partially or wholly supported by their parents. As a result, Gen Zs exhibit a slightly higher risk tolerance.

Former AirAsia pilot and now IQI’s youngest team head Jayden Ng noted that younger people take risks and invest more, knowing that in the worst-case scenario, they could go back to their parents’ homes. This segment may lean towards high-potential, smaller investments or properties requiring moderate renovation, focusing on capital appreciation or fast rental yield.

On the other hand, Millennials, aged from 30 to 44, having entered the job market during or shortly after major global financial crises and often already bearing greater personal responsibilities like marriage or children, tend to be more conservative. Ng described them as "more conservative and save more because they have less backup". Their property choices often prioritise stability, location efficiency and long-term asset security, making them reliable buyers for entry-level family homes or established investment properties.

However, the cautionary voice of top IQI performer Emily Goh reminds people not to overgeneralise. "Not everyone is ready to take big risks... Some still feel unsure about money or are just trying to get by. It depends on each person’s situation." This heterogeneity requires developers to offer a diverse range of products—from micro-units and co-living spaces for risk-taking singles to affordable, well-connected starter homes for families.

Redefining prosperity

Perhaps the most significant challenge to the traditional real estate model is the redefined concept of wealth itself. For these generations, success is no longer synonymous with the conspicuous consumption of a massive, expensive house. Instead, it is intrinsically linked to financial security, personal freedom and holistic well-being (physical and emotional).

This mindset repositions property from being the primary status symbol to becoming a tool that enables a desired lifestyle.

- Prioritising freedom and flexibility: "For our generation, being rich can mean having time for yourself, being able to travel or doing work you enjoy," stated Goh. This fuels demand for properties that facilitate mobility and passive income. Investment properties, which provide rental income to offset mortgages or fund travel, are often preferred over a sprawling, high-maintenance personal residence.

- The value of meaningful contribution: Jayden Ng expressed that the benefit of wealth extends beyond the self: "I can drive a nice car and have a nice home, but I can also teach skills to those around me... If I have extra, I will use it to invest in younger people so they can get ahead, too.” This moral component suggests a potential future appetite for impact investing or properties that facilitate community and mentoring.

- The search for balance: Jia Yin articulated the generational preference: "Wealth isn’t just about having luxury items or a big bank balance. It’s about time freedom, flexibility, and meaningful work." This underscores the need for transit-oriented developments (TODs), mixed-use projects, and properties with integrated amenities that minimise commute times and maximise quality of life, allowing for balance. Developers must focus on the utility and lifestyle integration of their projects rather than sheer square footage.

Empowered young women

The third major trend is the emergence of Gen Z and Millennial women as confident, autonomous financial decision-makers and significant property investors—a stark contrast to the dynamics of previous generations where financial planning was often delegated to male partners.

This demographic is actively building investment portfolios, starting side hustles, and purchasing property independently, driven by a desire for control over their future and lifestyle. This rise of the female investor is a demographic imperative for the real estate industry, requiring more tailored marketing, financial education resources and property offerings that appeal to single, professional women seeking reliable investments and secure living environments.

This article was first published on Starbiz7.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development and lifestyle trends when you subscribe to our newsletter and follow us on social media.