By Viktor Chong viktorchong@thestar.com.my

The long shadow of Covid-19 has spread across the entire globe, bringing about a temporary recession on an international level. As it continues to hopscotch about continents unchecked, local industries are feeling the pinch on both the macro and micro level.

In Malaysia, and especially towards the property market, investors, speculators and house buyers alike may share concerns, since we are here facing multiple whammies — including the political uncertainty due to a new government, drop in oil prices, and an already soft property market.

Does this, in the market sense, translate to a lower low from the previous low? Or does it resemble a situation where value investors purchase cheap stocks of fundamentally strong companies as they wait it out? Here are what the experts have to say:

According to Kopiandproperty.com executive editor Charles Tan, the property market should be viewed in terms of supply and demand, not by trend. To demonstrate his point, Tan said people may not be able to purchase handphones or go out on vacations now, but that does not represent the situation in perpetuity. The Covid-19 has also exhibited its vulnerability in China, where a few months of lockdown period had largely pacified the contagious virus.

Tan said that the median age for Malaysian is just 30 years old, which makes Malaysia a good country for property investment purposes.

“After the movement control order, people will still complete their studies. People will still migrate to bigger cities. People will gravitate to places where there are new jobs,” said Tan, adding that households will continue to be built and this shall drive the demand for property.

“Even with the Covid-19, things will go on as humans can change and adapt,” he explained, referring to humanity’s ability to utilise technology to overcome the virus, which is seen through the usage of digital communication to replace face-to-face conversation.

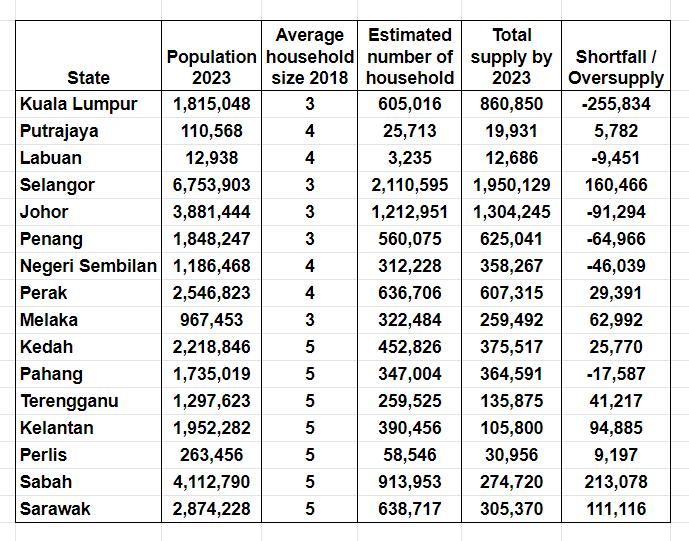

Estimate supply of residential units by 2023 in Malaysia considering agricultural and farming / plantation villages

Addressing the soft market, REI Group of Companies CEO Dr Daniele Gambero said the current property overhang involves certain products at specific locations, and the issue should be resolved within a few years.

He advocates the term Propenomy, explaining that properties shall always be looked at from an economic point of view. A good economy means growth and job opportunities, which in turn attracts migrants that drive the demand for property. In his terminology, migrants are people who move from one state to another within the same country.

When looking for a property, he suggested that house buyers search for economic drivers that justify the creation of the development. These economic drivers or similarly known as catalysts are such as educational institutions, manufacturing industries, warehousing, and transportation hubs.

Another important factor to consider is the constitution of buyers in a development project. Gambero advised that there should be a healthy mix between people buying the units for home usage and rental generation.

If a majority of the buyers are composed of property investors, then a price war may happen, both on the rental and also the value of the property. Since these individuals are purchasing for investment purposes, their holding power is likely to be shorter compared to those who purchase for their own use, Tan stated.

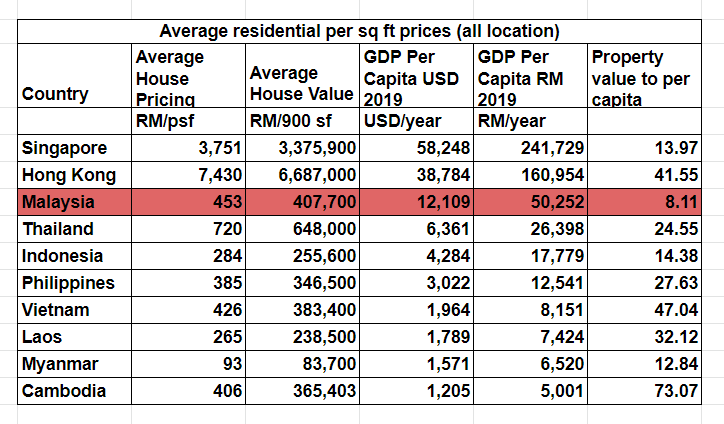

Malaysia charts lowest performance in terms of property value per capita based on the charts

On another note, Gambero forecasted that the property market might not hit bottom this year, saying that Malaysia has among the cheapest properties in the region. He believes the situation is best assessed by comparing income per capita to the average value of properties in the country.

In this scenario, Gambero pointed out that Malaysia charts the lowest performance in terms of property value per capita. “You have the property values bottoming out if there is a wave of properties being dropped by speculators,” he concluded.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.