With government support, increasing foreign investment and growing regional integration, Malaysia’s industrial property market is set for transformation.

Strategic advantages and government initiatives are transforming the nation into a regional industrial hub

By Pavither Sidhu

Malaysia’s industrial sector is undergoing one of the most dynamic transformations in recent years. Once known as a basic manufacturing base, the country is now rapidly climbing the value chain. It is embracing advanced technology, focusing on sustainability and forming strategic partnerships to secure its position as a regional industrial powerhouse.

This is reshaping Malaysia’s position in global supply chains and driving new demand for industrial properties such as high-specification factories, logistics centres and eco-friendly warehouses. For investors, developers and businesses, the market shows signs of long-term growth.

With this momentum in place, can Malaysia support the large, fast-track industrial projects global investors want?

Industry experts say Malaysia has several advantages. Firstly, its central location in Asean, with good connections through Port Klang, Penang Port and Johor’s Port of Tanjung Pelepas, makes it a natural logistics hub. Air cargo facilities at Kuala Lumpur International Airport (KLIA), Senai and Penang make it attractive for high-value manufacturing and regional distribution.

Secondly, developers are meeting demand by offering large-scale and modern industrial parks. Projects like Kulim Hi-Tech Park in Kedah, Batu Kawan Industrial Park in Penang and Elmina Business Park in Selangor offer ready-to-use facilities with utilities, internet and labour quarters, allowing manufacturers to set up quickly in the region.

To enable all these, government support is crucial. The Malaysian Investment Development Authority (MIDA) and state investment agencies now offer fast approvals and targeted incentives. High-profile investments by Intel (RM30bil in Penang) and Tesla’s regional base demonstrate that Malaysia can secure and support mega projects.

Additionally, MIDA plans to grow the data centre sector by investing in solar projects and improving solar farm efficiency. The government is also developing an aerospace manufacturing ecosystem, attracting investments in high-value components and sustainable aviation technologies.

Global realignment

Malaysia is benefiting from the China-plus-one strategy. With geopolitical tensions, supply chain problems and rising costs in China, global manufacturers are looking to diversify their production footprints. Malaysia’s stable government, bilingual workforce and well-established trade infrastructure make it compelling, as is evidently seen.

Electronics, automotive components and green energy manufacturing are seeing more foreign direct investment (FDI). Johor, Penang and Klang Valley have emerged as hotspots and are supported by major infrastructure projects such as the East Coast Rail Link (ECRL) and Pan Borneo Highway. These corridors are opening new industrial zones and improving connectivity between ports, airports and manufacturing hubs.

AI-integrated facilities with predictive maintenance systems, smart warehousing solutions and real-time energy monitoring are attracting global attention.

Tech infrastructure

The driving factor of Malaysia’s industrial evolution lies in a technological revolution. Industry 4.0 adoption, guided by the government’s Industry4WRD policy, involves the integration of artificial intelligence (AI) and the Internet of Things (IoT). It creates smarter and more efficient manufacturing processes, especially in the high-tech fields like semiconductors and biotechnology.

Through its Industry4WRD policy and the National 4IR Policy, the government aims to boost competitiveness, attract investment and foster a skilled workforce to become a global hub for smart manufacturing.

Industrial parks are beginning to reflect this transformation. Developers are rolling out AI-integrated facilities with predictive maintenance systems, smart warehousing solutions and real-time energy monitoring. Such infrastructure improves efficiency, making it appealing to multinational corporations seeking resilient, high-tech supply chain ecosystems.

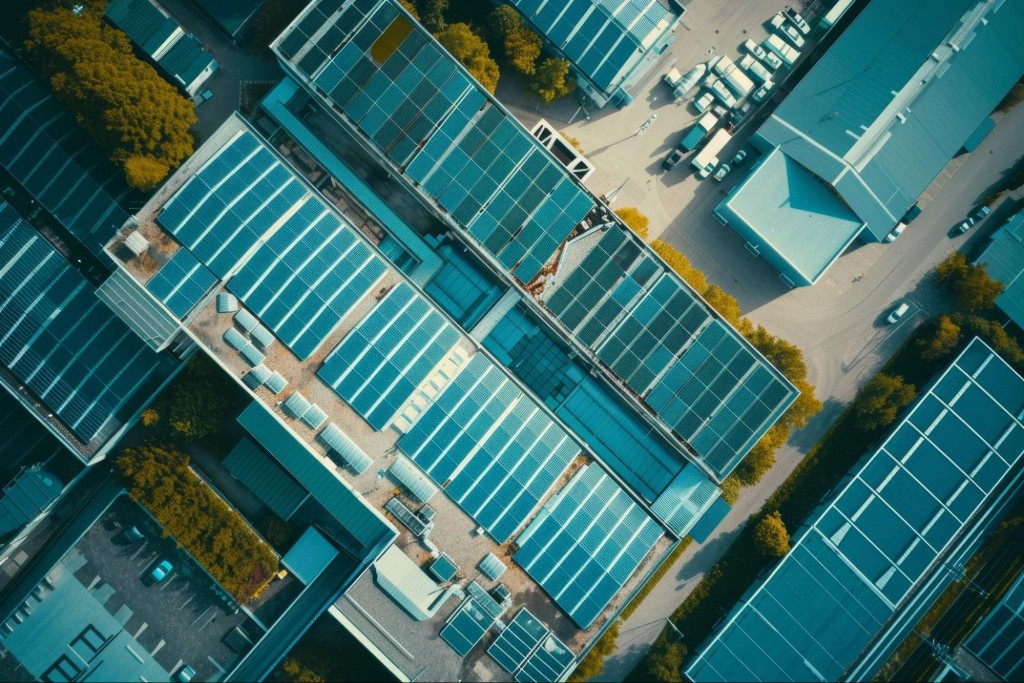

Developers are responding with ESG-compliant facilities with solar-ready roofs, rainwater harvesting systems and energy-efficient building designs.

Sustainability taking greater precedence

Sustainability is reshaping the industrial property market. Malaysia’s Green Technology Master Plan aims for 40% renewable energy by 2035, with industrial sectors expected to play a leading role.

Industrial occupiers, particularly multinational corporations facing increasing pressure from global sustainability reporting requirements, are prioritising environmental, social and governance (ESG) adoption to meet compliance standards.

Developers are responding with ESG-compliant facilities with solar-ready roofs, rainwater harvesting systems and energy-efficient building designs.

The growth of cold-chain logistics and green warehouses shows how sustainability meets new consumer behaviours such as e-commerce and food delivery.

Semiconductor ambitions

The semiconductor sector shows Malaysia’s future direction. Long known as a hub for back-end testing and packaging chips, the nation accounts for about 13% of the global market. Signalling a decisive move upstream towards chip design, GPU manufacturing and advanced production, the government aims to attract investments.

Penang remains the industry’s crown jewel, drawing US$12.8bil (RM54.08bil) in semiconductor investments in 2023. Global players like Intel, Infineon and Micron are growing while the RM25bil National Semiconductor Strategy aims to train 60,000 engineers to support next-generation demand.

Bucking the trend, Selangor recently launched Southeast Asia’s first integrated circuit (IC) in Puchong to signal Malaysia’s ambition to build design skills and become a full-fledged semiconductor hub.

Investment and trends

The industrial property sector has emerged as one of the strongest performers in Malaysia’s real estate landscape in the first quarter of 2025 alone. Further strengthening this, MIDA approved RM30.5bil in manufacturing investments, 83.8% of which came from foreign sources. These projects are expected to create more than 18,000 jobs, with significant spillover effects on industrial property demand.

Prime locations such as Klang, Shah Alam and Johor’s Iskandar region need more modern facilities. Demand for large-format warehouses, logistics centres and custom-built factories is pushing rents and land values upward.

This has pushed developers to work directly with businesses and increasingly adopt a built-to-suit model to integrate facilities with advanced technology, green features and tailored logistics requirements.

The outlook for industrial real estate is further boosted by the growth of e-commerce. With consumers expecting faster deliveries, distribution centres near urban hubs are in high demand. Cold storage and pharmaceutical-grade facilities are also growing fast, offering good investment opportunities.

Regional integration and SEZs

Cross-border connections will shape Malaysia’s industrial future. The Malaysia–Singapore Special Economic Zone (SEZ) in Johor is perhaps the most anticipated initiative. Expected to generate about US$26bil (RM109.82bil) annually by 2030, it will offer tax benefits—including a 5% corporate tax rate and 15% personal income tax—to attract high-value industries.

Tech companies like Microsoft and ByteDance are interested, particularly in data centre development. Johor, with its cheaper land and energy compared to Singapore, is becoming Southeast Asia’s next data centre hub. By 2035, industry estimates suggest capacity in Johor could increase sixfold.

The SEZ will also drive demand for industrial and logistics properties nearby, creating ripple effects across Johor and beyond.

Malaysia could not only attract but also deliver on the demands of large-scale, fast-track industrial developments.

Challenges ahead

Despite the positive outlook, challenges remain. Shortages of skilled workers, especially in engineering and digital technologies, could slow growth unless training improves. Rising construction costs and limited land in prime locations also create problems for developers.

Land and regulatory approvals and coordination at the state level can slow timelines despite federal-level facilitation. Utility readiness, particularly in terms of reliable power, water and gas supply, continues to be a pressing concern in newer industrial areas. Logistics problems, including port congestion and limited rail freight, pose risks for large-scale operations.

Furthermore, Malaysia must balance industrial growth with good urban planning and environmental protection. Without careful oversight, rapid industrial growth risks straining infrastructure, displacing communities and undermining sustainability goals.

Labour supply is another factor under scrutiny. While Malaysia boasts a skilled workforce in electronics, automotive and chemical manufacturing, reliance on foreign labour and tightening regulatory requirements have raised questions about scalability.

A market in transformation

Malaysia’s industrial market is clearly moving toward high-value, technology-driven and sustainable growth. From AI-enabled factories and eco-friendly logistics centres to semiconductor innovation and renewable energy, the sector is redefining its role in the economy.

For industrial property stakeholders, this transformation presents both challenges and immense opportunities. Developers who embrace ESG standards and high-tech infrastructure will attract tenant demand. Investors who align with long-term trends in e-commerce, semiconductors and green logistics can expect good returns.

Malaysia’s industrial sector is no longer just about low costs—it is about capability, innovation and sustainability. With government support, increasing foreign investment and growing regional integration, Malaysia’s industrial property market is set for transformation.

Looking ahead, analysts believe Malaysia’s prospects are strong. The government’s National Industrial Master Plan 2030 (NIMP 2030) envisions the country as a leader in advanced manufacturing, digital economy and green technology.

If supported by policy consistency, faster approvals and infrastructure upgrades, Malaysia could not only attract but also deliver on the demands of large-scale, fast-track industrial developments — while unlocking new growth corridors in the property market.

A thriving property market around industrial growth

Industrial expansion is boosting the surrounding property market as evident in Penang’s Batu Kawan. The influx of multinational companies has increased demand not only for industrial land but also for residential and commercial developments. Property analysts note that land prices there have risen from RM30 per sq ft to RM40 per sq ft a decade ago to RM80 per sq ft to RM120 per sq ft following major investments by Intel, Micron and others.

A similar trend is evident in Johor, where the growth of the Iskandar region and the Port of Tanjung Pelepas has increased demand for both industrial and residential real estate. According to Knight Frank Malaysia, certain industrial land parcels in Iskandar have appreciated by over 50% in the past five years. Residential projects in areas such as Gelang Patah and Nusajaya benefit from the wave of industrial activity and demand from Singapore.

In Selangor, large-scale developments like Elmina Business Park have created a chain reaction, increasing land values in Shah Alam and surrounding areas. Analysts say this pattern demonstrates the multiplier effect of industrial investments.

“When a major manufacturer sets up operations, it doesn’t just impact the industrial park, it transforms the entire local economy. Housing, retail and services all rise in tandem. Every major investment has translated into stronger demand for homes, retail and even education facilities in areas with industrial hubs,” said Knight Frank.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development and lifestyle trends when you subscribe to our newsletter and follow us on social media.