BY LEONG HUNG YEE

KUALA LUMPUR: Mah Sing Group Bhd posted a net profit of RM90.42mil on the back of RM723.5mil revenue in the first quarter ended March 31, 2017 (Q1, FY17).

The property developer’s pre-tax profit rose 6.9%, or RM7.8mil to RM120.6mil mainly due to higher profit recognition from completed projects in the current quarter.

It said its revenue from property development was about RM633mil and operating profit was about RM113.7mil in Q1 FY17.

As at March 31, the group’s cash and bank balances amounted to RM837.6mil. Mah Sing also recorded a low net gearing of 0.02 times, which is well below its internal target of 0.5 times.

“With our two recent land acquisitions in the Klang Valley, coupled with our existing landbanks, we are in a better position to meet the market’s demand for affordably priced homes in strategic locations.

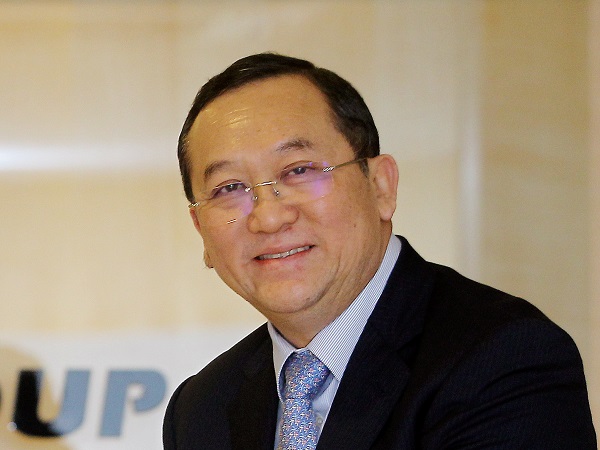

“We are also looking out for more landbanks. Of course any new land acquisitions will need to be strategic and we will adhere to our prudent financial policy of maintaining a healthy net gearing ratio,” group managing director Tan Sri Leong Hoy Kum said in a statement.

Mah Sing recently acquired two parcels of prime freehold lands to offer quality products at affordable pricing. The 8.5 acre land in Sentul and 3.56 acre land fronting Titiwangsa Lake Gardens are expected to yield a combined potential gross development value (GDV) of approximately RM1.95bil.

Its land in Sentul will be developed into M Centura and plans to offer residential suites with indicative built up from 650 sq ft, indicatively priced from RM326,000. M Centura fronts Jalan Sentul Pasar, just opposite Sentul Point.

In regards to the acquisition of the land in Titiwangsa, Mah Sing Properties received a letter dated May 26 from Messrs. Abdullah Chan & Co., Advocates & Solicitors, that there is a competing claim to the rightful ownership of the land, of which the Group and its legal counsel are in the course of verifying.

Mah Sing said a further announcement would be made in due course, where applicable.

“With the group’s two latest land acquisitions, Mah Sing’s prime landbanks, currently stands at 2,255 acres, with total remaining GDV and unbilled sales of RM31.5bil,” it said.

In the first three months, Mah Sing said it achieved property sales of approximately RM410.3mil, by offering products in line with market demand, namely beginner homes for the mass market and also upgrader homes in selected locations. Approximately 70% of the sales achieved were from projects in Greater KL.

Meanwhile, Mah Sing believes that the property market was currently undergoing consolidation, with healthy mid to long term prospects due to strong fundamentals such as young population, stable employment and the continued development of public transport infrastructure.

“According to Bank Negara, the Malaysian economy is still resilient with continued GDP growth. In 2016, the growth rate is at 4.2% and it is expected to have a growth rate of 4.3% - 4.8% in 2017.

“Properties in the affordable range is still seeing good demand, and in 2017, the group has lined up launches with estimated GDV of approximately RM1.9bil, and targets 73% of residential sales priced below RM700,000,” it said.

Follow us on Wechat or Facebook for the latest updates.

Download StarProperty.my e-Mag(bit.ly/StarProperty_Emag) for more articles.

Want to contribute articles to StarProperty.my? Email editor@starproperty.my. [slider id='81590' name='StarProperty' size='full']