With ECRL cutting down travel time to 4 hours from Gombak to Kota Bharu, the ECER sees a bright future

By: Yip Wai Fong

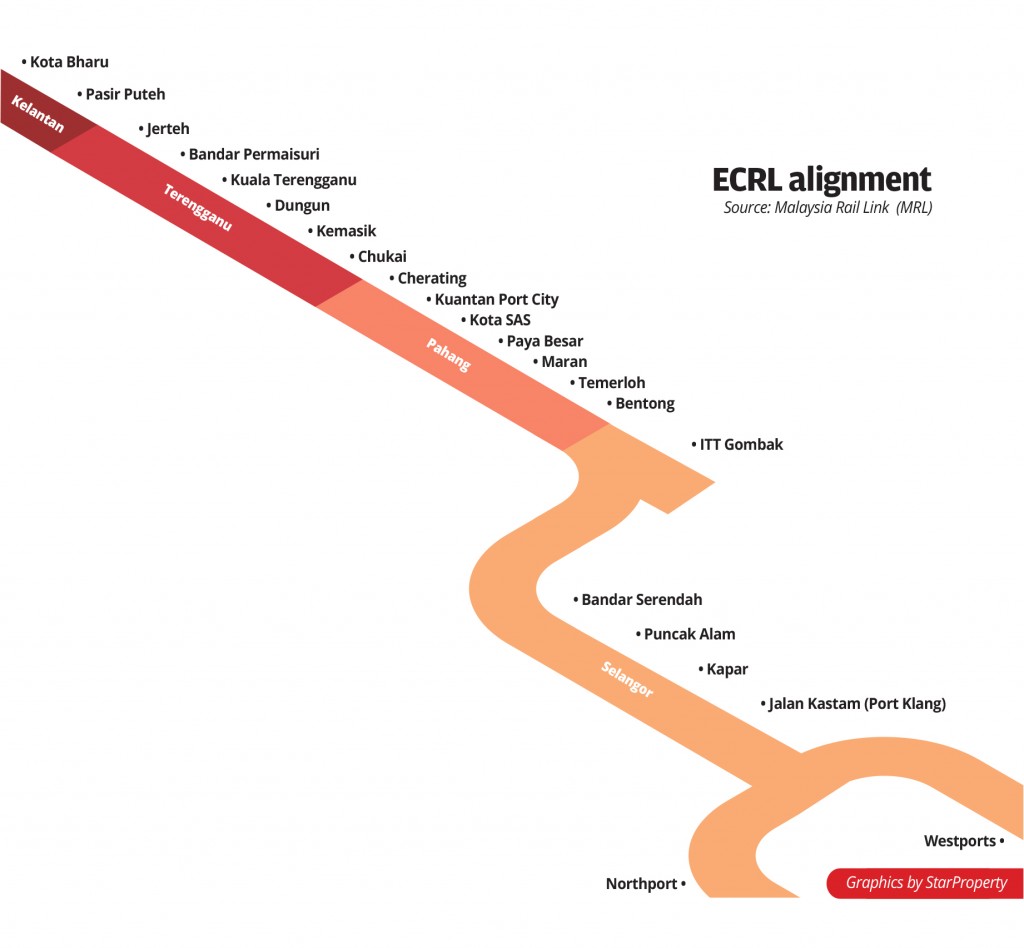

The 665km-long East Coast Rail Link (ECRL), stretching from Kota Bharu in Kelantan, traverses Terengganu and Pahang before ending in Port Klang, Selangor, is touted as a catalyst for development in the east coast, especially for the East Coast Economic Region (ECER).

Covering an area of 69,000 sq km, ECER spans the states of Kelantan, Terengganu, Pahang as well as Mersing and Segamat districts in Johor. ECER’s launch predates the ECRL; the initiative was launched in 2007 to change the east coast’s economic landscape and has survived successive governments. Groundwork has been laid, with infrastructures such as industrial parks and ports developed to attract investment. Leveraging on the upcoming ECRL, ECER has high hopes to unlock its potential. StarProperty speaks to the East Coast Economic Region Development Council (ECERDC) chief operating officer Datuk Ragu Sampasivam to find out more about the prospect.

ECERDC is the statutory body established to spearhead the policy and implementation of ECER developments.

Diversifying the economy

StarProperty: While Pahang has an industrial base, the east coast states of Kelantan and Terengganu are mainly agricultural states. How does the ECERDC plan to develop an industrial base for these two states?

Ragu: What people don’t realise is that the oil and gas base in Kemaman (Terengganu) started earlier than the Gebeng Industrial Area (in Pahang). ECER started during the late Tun Abdullah Ahmad Badawi’s time and we are now 17 years in existence. In 2010, when former Prime Minister Datuk Seri Najib Razak took over, he wanted us to refocus. So we had a first special economic zone on the east coast, the ECER Special Economic Zone, which starts from Kerteh, Paka, right down to Pekan and the Gambang water side. We call it the ECER SEZ. The industry was concentrated in those areas – in Pekan, we have the automotive hub and oil and gas in Gebeng, Kerteh and Kemaman. We were trying to optimise that. The first thing we did was expand the Kuantan Port. We built a 4.6km breakwater, completed seven years ago. The old one was very shallow – 11m, it couldn’t bring in bigger ships. Now with the new one, it can go up to 18m depth.

We did some corrections, infrastructure-wise. One was to expand the Kuantan Port. The second was to have a rail system. The rail would connect the whole of the east coast. We also look at other industrial spots like Pengkalan Chepa, Kota Bharu – that’s the main industrial area in Kelantan. Tok Bali is up and coming, and it straddles the Terengganu border. We are looking at Tok Bali as the second node for industrialisation. We have fisheries, an integrated fishery park, the Malaysian Fisheries Development Board (LKIM) started and expanded in Tok Bali and now we are coming up with the Tok Bali Industrial Park.

The other organic growth is in Temerloh and Gua Musang. So, yes, the states were agricultural and we wanted to balance the economic contribution and growth with pockets of industries. We didn’t go all out for industrialisation, as we are looking at the region’s existing advantages. We are looking at oil and gas downstream and minerals – that is why you have steel mills there, we are now looking at silica and the new one is rare earth. The bulk of it is in Kelantan. So we are looking at the region’s advantages and seeing how to build on them.

We also don’t let go of agriculture. Farm Fresh comes from Muadzam Shah (in Pahang). We developed the infrastructure for farming... and Holstein Milk Company (Farm Fresh’s former name) was selected and became the anchor company. We provided the farm, cowsheds and a processing area but the equipment and livestock were from the company. It was a public-private model through a proper and open bidding. We advertised it in the national newspapers.

(Another is) Rompine pineapple from Kuala Rompin and we developed the 1,500 acres. Again, we had an open bidding and we got the company to become the anchor. In the case of Rompine, we required that they help with the economic development of the Orang Asli community there. So a cooperative was set up and quite a number of Orang Asli worked with that. We always try to see that locals are able to participate in our projects. These two – Rompine and Farm Fresh are our biggest success stories. We have replicated Farm Fresh’s model in Mersing (Johor). We have just completed a second farm of that size which is going to be operated by a private company.

Under the 13th Malaysia Plan, the east coast is supposed to be the country’s food basket. That is a concept that we push for the east coast as well. It is in our Masterplan No 3. We call it ECER Development Plan 2026-2030. It was adopted in the 13th Malaysia Plan. We are looking into replicating the dairy farms in Kelantan and Terengganu so that our dependency on the import of fresh milk will become near zero.

Going back to your question on industrialisation, we wanted to have a more diversified economic sector in the state and to optimise the resources, as oil and gas will be depleted. We wanted to do oil and gas downstream in the region.

StarProperty: Pengerang is known as a downstream hub for oil and gas. When you say the region wants to look into downstream activities, is there a plan to develop a second hub similar to Pengerang?

Ragu: That is not the case. In fact, Pengerang is a replication of the east coast. We already have BASF Petronas Chemicals for almost 20 years. We have Kaneka Corporations and a few other chemical companies in Kuantan before Pengerang started. ECER started before Pengerang and initially Kota Tinggi was to be included as part of ECER, so that Pengerang would have been part of it. But it didn’t materialise. In any case, our focus will be on processing the oil and gas sourced from the east coast, whereas Pengerang processes the oil and gas sourced from elsewhere. We are not looking to be as humongous as Pengerang. We will be adding value along the path of developing specialty chemicals. Companies such as BASF Petronas Chemicals and Kaneka are into developing new chemicals required in the world’s market. We are facilitating companies in ECER to open their facilities here. I don’t see that we are competing with Pengerang. We are just building upon what is already on the east coast.

StarProperty: Is it then not so much about developing an industrial base in Kelantan and Terengganu but more about modernising agriculture and adding value to the produce? Is this the focus for the two states?

Ragu: I wouldn’t say just for the two states but the whole of ECER. When ECER was formed, there were clusters of focus – manufacturing, oil and gas, agriculture, tourism and human capital. We had started with those first. Logistics came later.

If you look at agriculture per se, the bulk is oil palm. The second would be paddy and that is already under a special (Federal) agency. We want to look into large-scale farms for three areas – livestock, fisheries and crops. For crops, pineapple is a successful example. For livestock, the successful one is dairy farming and for fisheries, we have a processing facility – Kuantan Fish Processing Park which we have replicated in Endau. In Tok Bali, we have expanded the fishery park for the private sector to come in. We are also looking at processing goat’s milk in Kelantan. We are looking at self-sufficiency in food agriculture. Certain vegetables are being grown in greenhouses by companies. We are promoting this to potential anchor companies. For companies such as Farm Fresh and Rompine, we build shell buildings for processing centres. They bring in the machinery. They do downstream activities such as packaging there. We’ve got an investor in durian farming in Pahang – Raub and Lipis are deemed the most suitable areas for durian planting – but then it didn’t stop Kelantan from having a large durian plantation in Lojing as well. So for agriculture, we have gone beyond just oil palm and padi and into other crop varieties.

We do the public-private model so that investors have a skin in the game. (Then) they have the incentive to make it successful. I’m proud to say that, when Muadzam Shah was constructed, it catered for just about 2,000 cows. The company had become successful and they had built additional facilities. Now they also put in extra fodder areas. They did it themselves. This shows it can be successful if the right company comes in. But we will provide the initial infrastructure to attract the companies.

StarProperty: What about the appeal of ECRL in ECER’s effort?

Ragu: When we started with Farm Fresh, the rail wasn’t in the picture. We concluded the study for the rail in 2014-2015. Then we went through the back and forth process of presenting the case and getting approvals and it was awarded to the contractor. Now it is under Malaysia Rail Link (MRL).

With the rail, companies like Farm Fresh can bring their products to Gambang, which then can be sent to Kelantan or to Port Klang in Klang Valley. The travel time between Kuantan and Gombak will be just 40 minutes for passengers, shorter than travelling to Ipoh. As towns like Slim River, Tanjong Malim, Sungkai and Slim River are booming because of the Electric Train Services (ETS), we feel that with ECRL, it will be a game changer for areas between Gombak and Kuantan. Travellers from Bentong to Gombak will take just 15 minutes. From Temerloh to Gombak, I think it will take an hour or less.

StarProperty: You also have freight-only stations.

Ragu: No, the stations are both for passengers and cargo. So chemical companies like BASF-Petronas Chemicals will use the rail to transport their hazardous chemicals to the port instead of using trucks on the road. This is a safer and greener way. The future companies will also benefit from the rail.

Eliminating red tapes

StarProperty: Will there be any policy liberalisation at these east coast states to attract investment? For instance, in land ownership policy?

Ragu: Yes. Like in Pasir Mas Halal Park, it allows for land ownership by anyone, not just for Kelantanese. This was started 15 years ago. There are certain restrictions in Kelantan when it comes to land ownership. There is limited land available for general ownership but the industrial parks have more liberal rules for ownership. No restriction on ownership.

Wherever we have joint developments for industries, we allow for ownership to encourage investment. The state agencies are also looking into more liberalisation of land ownership to encourage investment, taking advantage of the rail. It is on-going and some of it has taken place.

StarProperty: This is an important piece of information because for investors, they may have a better picture about the processes on the west coast but on the east coast, it is reassuring that there will not be an issue when it comes to land acquisition for development of their industry.

Ragu: We are looking for balanced growth. In fact, we are also looking into tourism. Our target for tourism is RM6bil, to get investors for our tourist spots so that the states can get tourist dollars while also maintaining the national parks and islands, capping the carrying capacity so that tourism won’t ruin the beauty.

StarProperty: What about the incentives for the Special Economic Zone?

Ragu: We had it until the end of last year, we call it the East Coast Incentive Packages. Certain areas of the Special Economic Zone had incentives of up to 15 years tax-free. But it ended on 31 December last year. Now the government is working on a national basis incentive. While they are finalising the scheme, we are working with the Malaysian Investment Development Authority (MIDA) under its incentives for investors. We try to put a better case for investors who we feel will be able to grow the region.

StarProperty: Again, the impression is that incentives come from the federal level only. Would the states provide incentives, too?

Ragu: They do. Some states, like Kelantan, have a list of incentives. Certain states provide water at a special rate, competitive land prices and so on. Some of them provide fast-track programmes, we have been working with Malaysia Productivity Corporation (MPC) to improve their deliverables. We have quarterly meetings with the chief ministers of each state and we highlight in those meetings, with the state secretaries, district officers, state development officers, economic planning officers, representatives from Investment, Trade and Industry Ministry (MITI), Finance Ministry (MOF) and Prime Minister’s Office (PMO) in attendance. In most cases, the states will be obliged to the requests. I must say the states are very cooperative when it comes to facilitating investments.

StarProperty: Can you give me an example?

Ragu: I think the ECRL is a classic example of how land acquisition processes were so fast. Within a year or so, they managed to lock the whole stretch; all the states worked with the Federal government to make it happen. Likewise, when we want to embark on a certain project for the state, they will make sure the land is acquired fast and the issues are sorted out.

We also chair quarterly meetings with the state planning directors to look at operational matters such as approvals at local councils. Sometimes we have investors who come to us and say, my building approval hasn’t come through or we would tell the state beforehand that the investors want the approvals fast. We really push to cut the red tapes. Investors also ask us whether, while waiting for approval, they can do land survey and clearing and we would facilitate their requests and the state governments work with us.

Talent development

StarProperty: What is the investors’ feedback on the matter of human resources?

Ragu: It is not so critical that things came to a standstill. We have training programmes to facilitate (talent development). I think so far it is okay. I have to mention BASF-Petronas Chemicals. They have been in ECER the longest and also companies like Kaneka and Camel Group, the battery manufacturer from China that opened their facility in Malaysia-China Kuantan Industrial (MCKIP). Camel Group is going to expand into phase two. If they have an issue, they wouldn’t be going into phase two. Of course, there would be gaps in the job market but it is not to the extent that nothing is happening. We have enough talent. I think with the connectivity improving, people would rather stay back in Kuantan. Some of the companies also offer attractive salaries that make the local talent stay. As we create the opportunities, people would rather work in the states than migrate to KL. There are many graduates on the east coast. They just need opportunities. We are okay so far.

StarProperty: Could you tell us more about the RM6.4bil investment in 1H2025 as displayed on the ECERDC website?

Ragu: The investment is a realised investment – works are already on the ground and money has come in. The main ones include a mini-hydro project by a private entity, petro-chemical downstream projects, which totals about RM1bil and a tourism project where a hotel is being built. The investments are across sectors and consist of both domestic and foreign investors.

StarProperty: The Prime Minister had just returned from a visit to China, where he met the China Communications Construction Company Ltd (CCCC - ECRL’s main contractor). Are there new investments from China in ECER? (Note: Prime Minister Datuk Seri Anwar Ibrahim went for a working visit to China from August 31st to Sept 3rd)

Ragu: I cannot comment about the PM but we work actively with our Chinese partners – Guangxi Beibu Gulf International Port Group, Beibu Gulf Holding and the Guangxi regional government. Guangxi is where MCKIP’s sister park, China-Malaysia Qinzhou Industrial Park, is. We are getting Chinese investments. I’m hoping to make an announcement before the end of the year that at least three Chinese companies will be investing in our parks. They are in the pipeline. The land purchase agreements are being finalised. These aren’t small investments. I’m looking at a total investment of RM2bil at least. We continue to work with MIDA, our partners and some of the business chambers here and in China and those are bearing fruit.

StarProperty: Last question, what are the sustainability aspects in ECER?

Ragu: As I mentioned, we don’t go full throttle into industrialisation. We look into developing food baskets and tourism to maintain the pristine sites and to have balanced growth. We did a rehabilitation project for Tasik Chini in 2014-15. That was the first. We have just completed a turtle sanctuary in Cherating, it was an upgrade of the old LKIM facility. We have done rainforest discovery projects, including facility upgrading work in Rompin Park. We hope that people will be more eco-aware and in Kampung Laut, we have helped restore a mosque. We also installed solar PV in some of the islands.

Sidebar 1: ECER’s thematic industrial parks

The ECER currently has seven thematic industrial parks to spur developments. Ragu told StarProperty of their latest status.

Pasir Mas Halal Park (PMHP)

Location: Pasir Mas, Kelantan

Land size: 108.7 acres

Focus area: Food beverages, non-food consumer goods, warehousing distribution and logistics

Status: 60% occupied

Kerteh Biopolymer Park (KBP)

Location: Kerteh, Terengganu

Land size: 439.8 acres

Focus area: Specialty chemicals, petrochemical products, biopolymers and biomaterials products

Status: Phase 1,2 and 3 are fully occupied, with some occupants expanding with new factory constructions. Phase 4 is upcoming.

Pahang Technology Park (PTP)

Location: Paya Besar, Pahang

Land size: 149 acres

Focus area: Data centre, e-fulfillment hub, renewable energy technology components, industrial biotechnology and biomedical applications and products

Status: An investor has signed up for 50%, with construction starting in 2026.

Tok Bali Industrial Park (TBIP)

Location: Pasir Putih, Kelantan

Land size: 200 acres

Focus Area: Construction and building materials, metal fabrication, edible oil industry, value-added assembly

Status: Under construction

Malaysia-China Kuantan Industrial Park (MCKIP3)

Location: Gebang, Pahang

Land size: 609 acres

Focus area: General manufacturing and high value added products

Status: 40% occupied. New investors are in the pipeline and will be announced in due time.

Gambang Halal Park (GHP)

Location: Paya Besar, Pahang

Land size: 170.5 acres

Focus area: Food beverages, non-food consumer goods, warehousing distribution and logistics

Status: “Gambang Halal Park is a bit slow but with the ECRL located about 500m away, we have been receiving enquiries,” Ragu said.

Pekan Automotive Park

Location: Pekan, Pahang

Land size: 237 acres

Focus area: Hybrid and EV, pick-up trucks and commercial vehicles, motorcycles, R&D and technology providers, automotive parts and components, automotive assemblers and car accessories.

Status: Left with 30 acres, with a new investor upcoming.

Sidebar 2: TODs on the east coast?

Other than industrial parks, two transit-oriented developments (TODs) are in the cards, located in Tunjong, Kota Bharu and Kotasas, Kuantan. The two upcoming townships are planned to be the new administration centres of the respective states. Would the TODs be able to attract the necessary growth? According to Nawawi Tie Leung Property Consultants executive director Saleha Yusoff, successful TODs require a critical mass supported by existing economic strength.

“Long-distance rail normally covers less urbanised areas. When this is the case, the ridership doesn’t have the critical mass to support demands for commercial products. TODs are typically a mix of residential and commercial, with the residential typically under the commercial category like serviced apartments. Compared to MRT and LRT in Klang Valley, these cater to urban commuters, so there is a high volume of ridership and they serve high-density areas. In such a case, the project owners and investors would have enough payback for long-term returns,” she explained.

Saleha, who has undertaken feasibility studies for TODs along rail projects for private clients, said that the east coast faces the question of building a sizable workforce.

“In Kelantan, the urbanisation rate is only 44.1% according to the Statistics Department. This denotes that the skilled workforce is less in the area and is insufficient to support commercial activities.

“Infrastructure alone – roads, utilities – is not sufficient to drive development. You need enough population. A retail mall, for example, needs at least a population of 300,000 to be sustainable. If the area does not have high-density housing, it probably doesn’t have enough population to support the mall. And population needs job opportunities,” she said.

Citing her studies for high-speed rail in Taiwan’s various areas – Taoyuan, Hsinchu, Taichung, Chiayi and Tainan, Saleha said it is not always the case that the TODs lead to high growth in employment and population. Certain stations like Taoyuan, located in Taoyuan City, Taiwan’s 5th-largest city, have not been able to attract developers’ interest to undertake development around the station. In Taichung, the initial development plan to build a shopping mall near the station failed to attract interest; instead, the plan was changed to develop logistics and warehouses, complemented by R&D, co-working space and retail.

Saleha said the studies also pointed to a few lessons. A collaboration between state governments and the private sector needs to bring in knowledge-intensive industries to become catalysts, to have a future-proof and flexible masterplan and not all stations should be designed for high density as long-distance rail is for long journey travels at a shorter time, making low and mid-rise buildings at a cheaper rate more feasible to cater to specific demand for SME.

“From investors’ point of view, they ask, is there an ecosystem to support their specific industry? So states like Kelantan need to build the ecosystem first,” Saleha said.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development and lifestyle trends when you subscribe to our newsletter and follow us on social media.