KUALA LUMPUR: Malaysia is maintaining its strong growth momentum, supported by a significant increase in domestic demand, improving labour market conditions and supportive government policies, albeit at a slow rate.

The property market recovered in 2022 in tandem with the reactivated economy, according to property consultancy Knight Frank Malaysia in its Real Estate Highlights 2nd half of 2022.

“In 2022, most of the world came out of intermittent lockdowns, and we entered a year of rising interest rates, geopolitical uncertainty, supply chain disruptions, and record inflation rates. The performance of the property market sector is in tandem with robust economic recovery, as Bank Negara Malaysia expects full-year growth to exceed its forecast of 7%,” said its group managing director Keith Ooi.

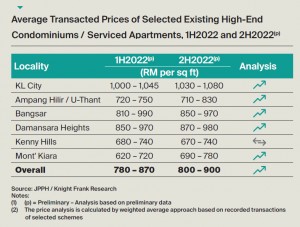

In the residential sector, high-end condominiums in the secondary market have seen an uptick in pricing. The rental market for high-end condominiums is also expected to remain positive, especially for new completions with upgraded features.

Research and consultancy senior executive director Judy Ong said purchasers are also more discerning about environmental impacts and seek sustainable features in their homes, while financial institutions are also introducing green financing facilities.

Figure 1: Average Transacted Prices of Selected Existing High-End Condominiums/ Services Apartments, 1H2022 and 2H2022

In Penang, the high-rise residential property market has registered higher annual sales volume and value as of Q3 2022. In Johor, although there was no new launch for high-rise residential property, sentiment has improved due to the progress of the rapid transit system (RTS) system in Johor Bahru City Centre, observed Knight Frank Johor associate director Tan Lih Ru.

In the office sector, increased leasing activity is seen in Selangor, particularly for Grade A buildings in prime locations. Overall, the Klang Valley market for offices is tenant driven and is expected to continue, where landlords will be focusing on retaining tenants with cost-optimization, asset enhancement initiatives, and leasing incentives.

The retail sector saw a strong rebound, driven by growth in retail sales that were at the revised rate of 41.6% for the full year. Research and consultancy executive director Amy Wong said that retailers are leveraging on flagship and specialty stores to increase sales and improve engagement. She also added that mall operators are currently adopting environmental, social, and governance (ESG) initiatives to adapt to shifting shopping patterns in the digital age.

In Penang, the overall occupancy level of existing shopping malls in the state remained above 70% and ground floor rental rates for selected prime shopping centres in Georgetown held firm.

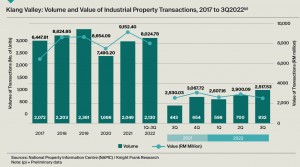

Another strong performer is the industrial sector. Wong said that the growth was driven by steady demand from both logistics players and investors, with Klang Valley remaining as one of the ideal destinations in Malaysia for nearshoring of firms with a focus on Southeast Asia as it offers the right balance between cost, efficiency and quality.

“The industrial property sector in Klang Valley saw a rebound in market activity with 2,049 industrial properties worth RM9.15 billion changing hands in 2021, reflecting annual increments of 21.5% and 22.2% in transacted volume and value respectively. The analysed average price per industrial transaction was marginally higher by 0.5%,” she said.

In the short and medium term, the sector in Klang Valley is expected to continue to perform strongly as better logistics infrastructure, increasing freight volumes, growth in e-commerce and supportive government policy are expected in 2023.

In Johor, the industrial property sector has performed positively with notable acquisitions of logistics warehouses, manufacturing plants and active expansions of data centres.

Recovery is expected to continue in 2023 against the backdrop of an uncertain global economy. Ooi said in the long term, the adoption of the ESG framework will drive the property value forward.

“We hope the government will introduce green incentives to property buyers, landlords, occupiers and developers who are aligned with the nation’s target of becoming a net zero nation by 2050,” he said.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.