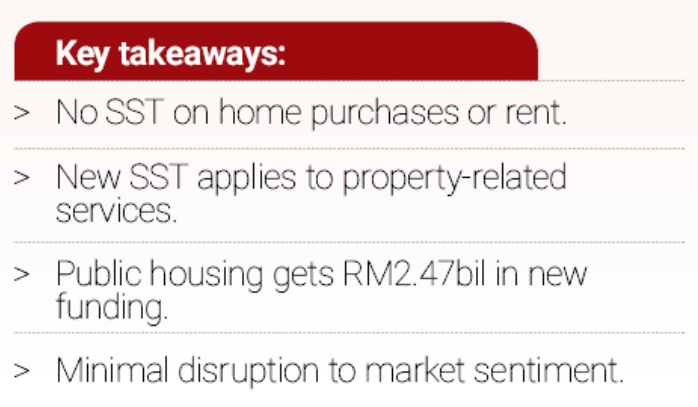

Malaysia’s latest Sales and Service Tax (SST) update brings welcome news for renters, first-time buyers and home owners. While the standard SST rate has been raised from 6% to 8% on most services, residential sales and leases remain entirely exempt, a move that industry players say will help keep housing costs stable and support broader homeownership goals.

Like many real estate stakeholders, Juwai IQI co-founder and group chief executive officer Kashif Ansari welcomed the news, adding that the exemption provides much-needed clarity and reassurance for the public. “Residential sales and leases remain zero-rated under SST,” said Ansari. “They are fully exempt from the new 8 per cent service-tax band.

For many Malaysians, the fear was that rising service taxes could translate into higher home prices or monthly rents. But the Finance Ministry has kept these essentials untouched by the new SST band, meaning renters and buyers will not face any direct new taxes.

“So, it is good news for renters, first-time buyers and home owners that the expanded SST doesn’t mean any new direct costs. Residential tenants remain exempt from the 8% SST on rent, so monthly payments stay unchanged,” said Ansari.

However, he cautioned that some indirect cost increases could emerge. Maintenance or repair bills now carry SST and agents’ lease-renewal commissions do as well. However, tenants can limit exposure by choosing units with all-inclusive service fees and negotiating lease terms that lock in costs.

For landlords, the changes are also modest. Although rent itself is not taxed, landlords will have to pay the 8% SST on supporting services such as plumbing, property management and security contracts. “We expect this to add to their total costs only marginally,” said Ansari.

A boost for housing initiatives?

The SST expansion is expected to significantly increase government revenue. According to Budget 2024, Malaysia’s SST is projected to collect RM44.7bil this year, up from RM36bil in 2023. That extra revenue could support major initiatives in housing and public infrastructure.

“That extra money can help fund Budget 2024’s promise to give an extra RM2.47 billion to public-housing projects. And a RM10 billion Housing Credit Guarantee Scheme will help 40,000 borrowers secure mortgages in 2025, especially gig economy workers,” Ansari pointed out.

The scheme, which removes the need for traditional payslips or income history, is seen as a crucial lifeline for self-employed Malaysians and young people struggling to break into the property market.

Room to grow

Despite the tax increase on services, Malaysia’s housing market remains resilient. Bank Negara has projected 2025 inflation at 2% to 3.5%, suggesting that the SST hike will not significantly erode consumer purchasing power.

Data from the Valuation and Property Services Department (JPPH) shows the Malaysian House Price Index rose by just 0.9% in the first quarter of 2025, reaching an average of RM486,070. Median condominium prices in Kuala Lumpur fell slightly by 2.4% while Selangor saw a 3.1% rise. Meanwhile, Johor’s serviced apartment overhang fell by 5.6% as cross-border demand from Singapore returned.

Rental demand remains strong in urban centres such as Kuala Lumpur, Penang and Johor Bahru, especially among young professionals and foreign tenants.

“We believe that buyer demand for well-located, high-quality homes will continue to pivot on fundamentals such as interest-rates, new infrastructure and incomes, not on this small tax tweak. Underlying demand for rental housing, especially in urban centres, also remains strong. So, residential markets should hold their trajectory with very little impact,” explained Ansari.

Developers to feel a tiny pinch

While buyers and renters are largely insulated, property developers may feel a slight pinch from the new SST framework. Construction-related services such as machinery rental, site security, logistics and professional consultation now fall under the 8% service tax.

“This could increase project costs slightly,” said Ansari. “However, developers have tools to counteract these rises, such as adopting modular construction, scaling down project sizes, or delaying launches until demand improves.”

Nonetheless, the higher cost of development could eventually be passed on to buyers although not immediately. Industry watchers expect developers to absorb some of these costs in the short term to stay competitive.

Common questions about SST

Many clients and agents are asking similar questions about the new SST changes. Among the most frequent concerns:

- Will homes cost more to buy?

The answer is no. Residential sales remain SST-free before and after the change, so buyers have no tax reason to delay or rush their purchases. - Is Airbnb affected?

Short stay stakeholders will be affected as any rental under one month is considered as accommodation services and are now subject to 8% SST. However, long-term residential rentals remain exempt. - Do mortgage payments go up?

Interest payments are not taxable under SST. However, some processing or documentation fees may now carry an 8% charge. On the bright side, these are usually one-off costs. - Do landlords need to register for SST?

Ordinary home owners and landlords are outside the SST system unless they provide taxable services beyond residential rent.

While most analysts see the tax change as a modest adjustment, industry leaders like IQI are keeping a close eye on how the economy reacts.

“At IQI, we will watch the roll-out closely. Should the economy or housing market show undue strain, I believe the authorities stand ready to fine-tune the rules. They might phase out certain measures or grant targeted relief to ease pressure on households and builders. Right now, we are cautiously optimistic that these measures protect buyers and renters,” said Ansari.

As such, the general sentiment is positive as the measures strike a balance between increasing government revenue and protecting the rakyat from unnecessary financial burden, especially if additional funds are injected into more affordable housing for the future.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development and lifestyle trends when you subscribe to our newsletter and follow us on social media.