For property seekers, Koe points to the OPR increase and the tightening banks as signs of the road ahead

By Yanika Liew

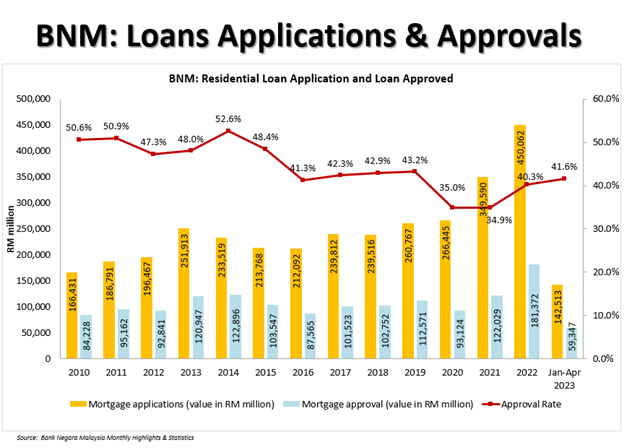

While the issue of unaffordability in housing often centres around the price of the project itself, financing plays a significant role in being able to afford a home. Acquiring a property requires the help of bank loans and yet financing remains an issue for a majority of Malaysians.

From 2014 to 2020, Bank Negara Malaysia reported that income rose approximately 2.1% while house prices grew 4.1%, growing faster than income can catch up to. The trend continues in 2023, with house prices steadily growing out of reach of ordinary households.

For property seekers, the overnight policy rate (OPR) has increased and the banks are tightening up, FIABCI Malaysia immediate past president Datuk Sri Koe Peng Kang pointed out in the recent StarProperty Budget 2024 Roundtable.

According to National Property Information Centre (Napic), the Malaysian House Price Index (MHPI) stood at RM453,365 per unit in the first quarter of 2023. The maximum price of an affordable home is to be set at RM300,000. To afford a house priced at RM300,000, the monthly household income has to be RM8,333. Despite this, 76% of households in Malaysia earn less than RM8,333, while only 36% of units are priced at RM300,000 and below.

When it comes to a financial health screening by the banks, the documents they will require go beyond the required income documents. Koe noted that there was also the borrower’s credit (CTOS) score, their CCRIS records, debt service ratio (DSR) score, and if applicable, their litigation and bankruptcy checks and trade reference listing.

The DSR is calculated through a borrower’s existing loans and compared to their income. Before the pandemic, Bank Negara reported that 76% of Malaysians have savings that can only cover less than three months of living expenses. This, combined with the fact that 65% of borrowers already have either car or personal loans, lowers a potential borrower’s DSR score.

Koe estimated that the debt service ratio limit from bank to bank stands at 50-80%, with a lot of loan applications rejected because of their DSR profile.

“One thing peculiar to me is, sometimes the borrower has never borrowed money, [but] they are rejected because [the banks] don’t know their background… If you build affordable housing, the B40 will be the biggest problem,” he said.

He noted that loan applications were always rejected because borrowers could not feasibly prove their earnings. With the rise of the gig economy, and more and more graduates participating as they enter the workforce, the situation has only gotten worse. In the eyes of the bank, those working in the gig economy do not have stable incomes.

A difference in assessment

“Even if that’s what they’re earning, [the banks] cannot give,” Koe said.

“We’re going to have a problem because, in the last 10 to 15 years, banking has changed. Banks now work on a risk basis, every banker is now 80% doing the job of a risk manager,” Sime Darby Property Bhd managing director Azmir Merican said at the StarProperty Budget 2024 Roundtable.

He pointed out that banks run models looking at the probability of risk and defaults. The issue of housing was an urban problem rather than a problem for the whole country.

“If you’re talking about housing, it is a problem of the urban society and urban society has got an income issue,” he said.

“Say, for example, we got two guys, early in their careers, earning RM5,000. That’s a risk issue for me… I have a problem thinking oh, I cannot afford it. I may not be able to afford it now, but as I progress in my career, I can afford it, then we talk about step-ups,” he added.

Step-up financing programs involve paying a lower monthly instalment for a selected number of years of the loan, with it increasing over time.

“In Mah Sing, our average conversion rate (loan approvals) stands at approximately 50%,” Mah Sing Group Bhd chief executive officer Datuk Ho Hon Sang said.

“This is mainly thanks to the support of our end financiers, many of whom have been on our panel for a long time. The affordable price points of our projects and availability of Step-Up Financing packages from end financiers have also played a significant role in boosting our conversion rate,” he added.

“As a property developer, Mah Sing has been working towards narrowing the affordability gap for our customers. One example is Mah Sing’s Secure Campaign in 1H2023 with features such as a fixed interest rate, step-up payment scheme, appealing packages and incentives, and additional rewards. The response from home buyers towards this campaign has been positive, primarily because lower initial home loan instalments during the first few years have improved affordability and resulted in higher approval rates,” Ho said.

A view shared by many developers, including Ho and participants of the roundtable event, was that the current challenges faced by homebuyers could be resolved by reinstating the Home Ownership Campaign (HOC). Currently, its successor, i-Miliki is running until the end of December 2023.

“We hope that banks can consider relaxing their approval criteria, particularly for genuine first-time home buyers. Besides that, banks can also consider giving lower, fixed-rate financing for properties priced up to RM500,000,” Ho said.

“It is essential for financial institutions to strike a balance between risk management and supporting responsible borrowers,” he added.

“We hope that banks can consider relaxing their approval criteria, particularly for genuine first-time home buyers,” Ho said.

“If you’re talking about housing, it is a problem of the urban society, and urban society has got an income issue,” Azmir said.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.

![“Even if that’s what they’re earning, [the banks] cannot give,” Koe said.](https://d21v4e61pe461s.cloudfront.net/wp-content/uploads/2023/08/koe_peng_kang-234x300.jpg)