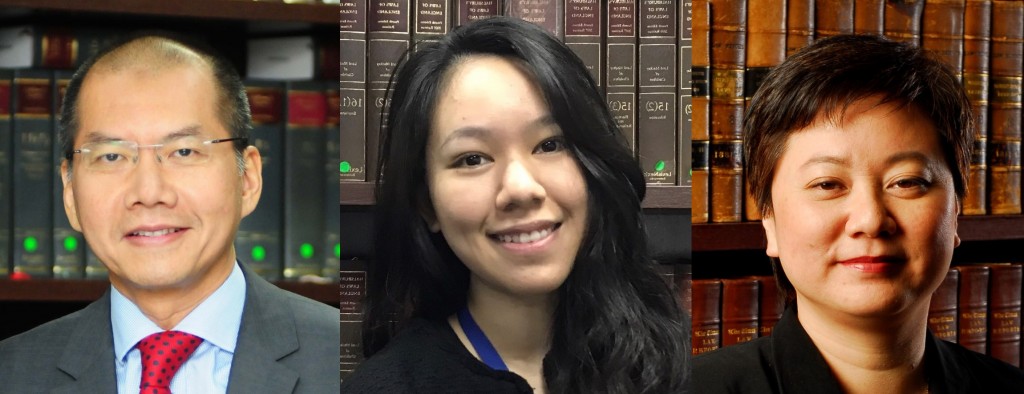

Contributed by Jal Othman, Hoh Kiat Ching and Amanda Tey

Much has been said about the Private Lease Scheme (PLS), labelling it risky, disastrous and worse, tyrannous.

This is due to the differences in its structure, compared to a traditional state leasehold title. However, what may not be common knowledge is that end-purchasers under a PLS can enjoy rights and benefits, similar to those afforded to state leasehold owners.

This article seeks to provide insight into some of the common criticisms of the PLS.

No proprietary rights to end-purchasers

One consistent criticism – under PLS, homebuyers will remain tenants in perpetuity, without proprietary rights. However, this will only be a cause of concern if the rights and benefits afforded to a State leasehold owner and the end-purchaser under a PLS differ so much that it is unfairly prejudicial, under PLS. Yet, this is not the case.

State leasehold owners also do not own lands in perpetuity, which revert to the state at the end of the tenure. They may apply to the state for renewal, but there is no certainty nor guarantee.

Writers have referred to the moral responsibility of the state to renew leasehold titles, but there is no obligation to do so under the law. If the land is required for public purposes, economic or redevelopment purposes, there is nothing to compel the state to grant a renewal. Even if renewed, the premium payable to the state may be high.

The PLS on the other hand can provide certainty, by expressly incorporating a right to renewal in the terms of the lease. The premium can also be agreed upfront by way of a specified sum payable, or in terms of a formula.

The PLS can be structured to afford ownership or proprietary rights similar to (if not better than) those given to state Leasehold owners.

Prices determined by market forces

Critics believe that the introduction of the PLS will cause housing prices to increase as the supply of property ownership reduces.

It is common knowledge that prices of properties are largely determined by market forces. If the concern is that prices of houses on freehold and state leasehold lands will increase dramatically because more of such lands are being put under a PLS, this concern is not consistent with the critics' proposition that many house buyers prefer to purchase property ownership rather than a lease.

If buyers ultimately prefer to have property ownership, PLS will not be a real threat. If it is not attractive to buyers, developers would not continue with the PLS.

Tropika Istimewa case

On Oct 7, 2020, the Kuala Lumpur High Court granted a declaration sought by 107 buyers of a condominium project under a PLS, that the developer, Tropika Istimewa Development Sdn Bhd, had misrepresented they were entering into a sale and purchase agreement (SPA) to purchase property and not to purchase a lease.

The court did not hold that all SPAs entered into pursuant to a PLS shall be invalid, rather that the SPA in this particular case misrepresented the transaction.

Parties are therefore still permitted to enter into SPAs pursuant to a PLS provided that the proprietors and developers do not misrepresent.

Housing development in Peninsular Malaysia is regulated under the Housing Development (Control and Licensing) Act 1966 (Act), and the sale and purchase of housing accommodation are governed by SPAs prescribed under the Housing Development (Control and Licensing) Regulations 1989 (Regulations). Parties entering into a SPA must comply with the relevant format prescribed.

Where the property under a PLS is a housing accommodation, the developer may not be able to comply with the prescribed format, without making amendments to it, which requires approval from the relevant authority.

The Court of Appeal in Loh Tina & Ors v Kemuning Setia Sdn Bhd & Ors and another appeal [2020] 6 MLJ 191 has also made it clear that a proprietor and a developer under a PLS cannot modify or waive the relevant format of SPA prescribed by the Regulations, to accommodate the structure of a PLS without first obtaining consent from the relevant authority.

As such, developers shall apply, by virtue of Regulation 11(3) of the Regulations, to modify or waive compliance.

Management corporation

The Tropika Istimewa case also brought to light the distinction between proprietors of parcels in a sub-divided building who are able to form a management corporation under the Strata Titles Act 1985 (STA), and end-purchasers under a PLS who are not permitted to form such a management corporation, being lessees and not proprietors.

In this connection, it is common for purchasers in a strata title development to enter into deeds of mutual covenants (DMC) with the developer.

The DMC regulates use and enjoyment of the common property. In the case of PLS, the DMC can be extended to establish rules relating to the management and maintenance of the sub-divided building.

The PLS by no means signifies that traditional property ownership would be replaced. It is merely a legal alternative for the purchase of interests in property.

Benefits of PLS

- Opportunities – Freehold landowners of ancestral land, unable to develop their lands due to financial constraints, will have the option to lease their lands for development, without giving up ownership.

- Accessibility for foreigners – to purchase properties, while ensuring the land continues to be owned by Malaysians. This also provides economic growth and development by bringing in foreign investments.

- Flexibility – to cater to other types of developments in Peninsular Malaysia, such as industrial or commercial. A commercial entity may prefer to lease premises in a shopping complex, rather than own a unit. This allows the freedom to leave the premises once the lease is up, especially if the business is not doing well at that location.

- A creature of contract – freedom to negotiate the terms, including the tenure, renewal, restrictions in interests and pricing. While proprietors and developers may have the power to settle the terms of the lease, such terms need to be attractive to end-purchasers. Contracts that disproportionately favour proprietors and developers would not be acceptable.

Rather than labelling it as risky, disastrous and tyrannous, more effort should be invested to educate on PLS, to resolve any confusion. All stakeholders should also work together to identify the real risks of the PLS and address the same.

The stakeholders should liaise with the relevant authorities to enhance the current framework under the Act and the Regulations, including formalising new formats of prescribed SPAs to cater to the PLS.

Similarly, stakeholders can also look into the legislation relating to strata title developments to determine necessary amendments to allow lessees of sub-divided buildings under a PLS, to enjoy benefits of forming a management corporation, amongst others.

There are sufficient benefits to the PLS to merit further consideration, rather than a disparaging dismissal.

At the end of the day, the question remains if PLS is a boon or bane? That is up to the landowners, developers and end-purchasers to decide. However, the law has decided that the PLS is fine and permitted as elaborated in Part One of our article.

From left are senior partner Jal Othman, associate Amanda Tey and partner Hoh Kiat Ching of Shook Lin & Bok, one of the largest law firms in Malaysia.

Disclaimer

This article is intended to convey general information only. It does not constitute advice for specific needs. This article cannot disclose all of the risks and other factors necessary to evaluate a particular situation. Any interested party should study each situation carefully. You should seek and obtain independent professional advice for your specific needs and situation.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.