Factors that determine the value of retail offerings

By Vicky How

With the evolving retailers moving into online marketing, the behaviour of consumers has changed drastically over a brief period of time. Rather than expanding the number of branches, many retailers have now shrunk down the retail units in shopping malls and instead opt for opening their branches outside the shopping malls.

Hence, many shopping malls face challenges when it comes to getting new tenants into their mall, while the shop lots close to shopping malls have seen an increase in demand.

The reason behind it is simple. The change in trend has prompted the retailers to look for a bigger space which is both visible and has the capacity to store their stock for online sales, in which they are able to sell their product nationwide. Hence, it is highly encouraged that property investors should also look into commercial property as an investment option.

How is your commercial property being valued?

When investing in commercial properties, one of the most important things is to know how to determine the value of a commercial property.

It is crucial that you know how the commercial property is valued, because like anything you buy, you don’t want to be ripped off. If you want to make an investment, you need to get a fair deal on the property. Otherwise, you might not get a decent return for what you pay for.

It is important to note that residential and commercial valuation processes are very different. A commercial property is a property that generates profit whereas a residential property is a place of residence.

Unlike residential properties, commercial properties valuation are less straightforward and hence require a specialist valuer to evaluate the property.

Commercial properties are generally larger and built on more expensive land than residential property, resulting in the involvement of a larger sum of money. The reason why the commercial land is more expensive than residential land is that developer pays a premium to convert an agricultural land to commercial land or from a residential land to commercial land.

The valuers, more often than not, will be looking into these few criteria while giving value to the property. These are the few tips that investors may also like to look into:

Location

There is no doubt that location is relatively important in determining a good commercial property investment. The location should be a crowd generating area, in other words, a good visibility and most importantly, good accessibility.

Having these two criteria for a commercial shop is like having free advertising every day.

For instance, a shop next to a highway may have a good visibility considering the fact that thousands and thousands of vehicles pass by every day. However, the good visibility which does not come with good accessibility will cause the road passers the trouble of getting to the shop.

That is why many of the commercial properties that situated next to main road or highway have good visibility but could not attract the crowd to the area, as most people cannot access the location.

However, certain commercial properties within the same development scheme have different values. Sometimes we come across some properties from different rows selling at different prices.

Usually, the one that faces the main road sells at a higher price. The differences in value are mainly due to the visibility and the crowd surrounding the commercial property.

Blue Chip Tenant

Imagine two commercial properties are up for sale: one is currently renting out to a bank, fetching a good rental yield and has a tenancy of five years while the other is vacant.

If you are an investor and you are not looking to use the premise for your business, without thinking twice, you will choose the tenanted property.

The reason is simple, we do not like tenants in and out of the building. Every time that a tenant moves out of the building, you have a cost to bear. Not only you have to touch up the building for the next tenant, you have to endure with the rent loss during the vacant period, this could be up to six months or more.

Having a long unexpired tenancy and a blue chip tenant means you could fetch the yield for at least five years despite an economic downturn. Besides that, the valuer will be looking at the financial performance of the company, usually, an MNC tenant can add to the value.

International or Renowned Local F&B

When sending an invitation for a meeting or gathering, it is common to meet up in a major local or international F&B location. Hence, having such a retail close to your commercial property will be an added value as it serves as a landmark to your location.

It will attract a crowd to your property, and also increase the demand of obtaining a unit of property in the location, and eventually, it will increase your the value of your property.

Rental Yield

The rental is set as a basis of return for the landlord and it determines as to whether the commercial property is a good investment. The rental is checked against the market rental evidence to test if the rental fetch is a fair market rental.

Certain unit maybe be rented out for a very high rental rate due to being a corner unit or it is situated in a particular row and hence attract a larger crowd or higher visibility.

The method of valuation should not just use a simple comparison method because there is a premium value involved. The comparison method is where the valuer will use the past sales transaction data in the area from JPPH to determine the value.

A decent commercial property usually fetches a yield from approximately 5% onward depending on the property area. To calculate your yield, you may use this formula:

Rental/Purchase Price ×100

Frontage

The frontage of the shop is relatively important as the things that display at the front of the shop help to attract the customer to walk in and convert into a sale. Hence, there is a premium given for the shop frontage.

In other words, the wider the frontage, the higher the value.

The valuer sometimes uses zoning method to calculate commercial shop such as corner units or shops with wider frontage.

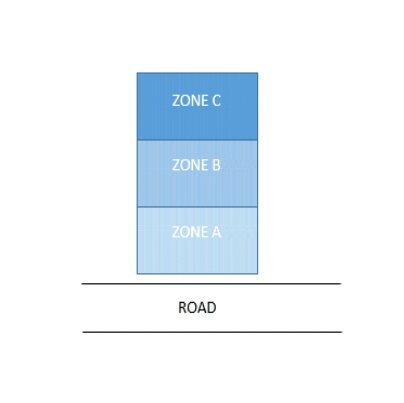

Zoning is when the commercial shop is divided into a few zones to calculate the value of the shop such as the picture below.

The Zone A will be given a higher value than Zone B and Zone C as Zone A is the area where most of the sales product could be display to convert into sales. While Zone B has a higher value compare to Zone C because Zone C is the part where sales generating does not comes in and it is normally used as a storeroom, office or kitchen.

Recently, there have been many budget hotels in town and many people been asking how will valuer these commercial shops valuation.

Since the hotel is a business generated property, the valuation of the commercial property relies on the profit and loss of the business.

When considering the potential of any hotel, the average room revenue is important as this contributes significantly to the profit. The average revenue of the hotel can be derived from the formula:

total rooms available ×room occupancy rate × average achieved room rate

The room occupancy rate is where at one time how many percentages of the total rooms are being occupied. This percentage varies from hotel to hotel and depends on the seasons.

Besides the room revenue, the food and beverages, telephone, and others should also be counted as revenue and any expenses of operating the hotel should be minus off. Then, the derived net profit is to be capitalised to obtain the value of the property.

Besides the budget hotel, we can also use this method for the pub and self-service laundry.

Vicky How is a licensed valuer registered with the Malaysian Board of Valuer, Estate Agency and Appraisal (BOVAEA). She is currently a director of Henry Wiltshire, an international estate agency company.

The views and opinions expressed in this article are solely those of the original author. These views and opinions do not necessarily represent those of StarProperty.my.