Financial institutions need to lend a helping hand

By Yip Wai Fong

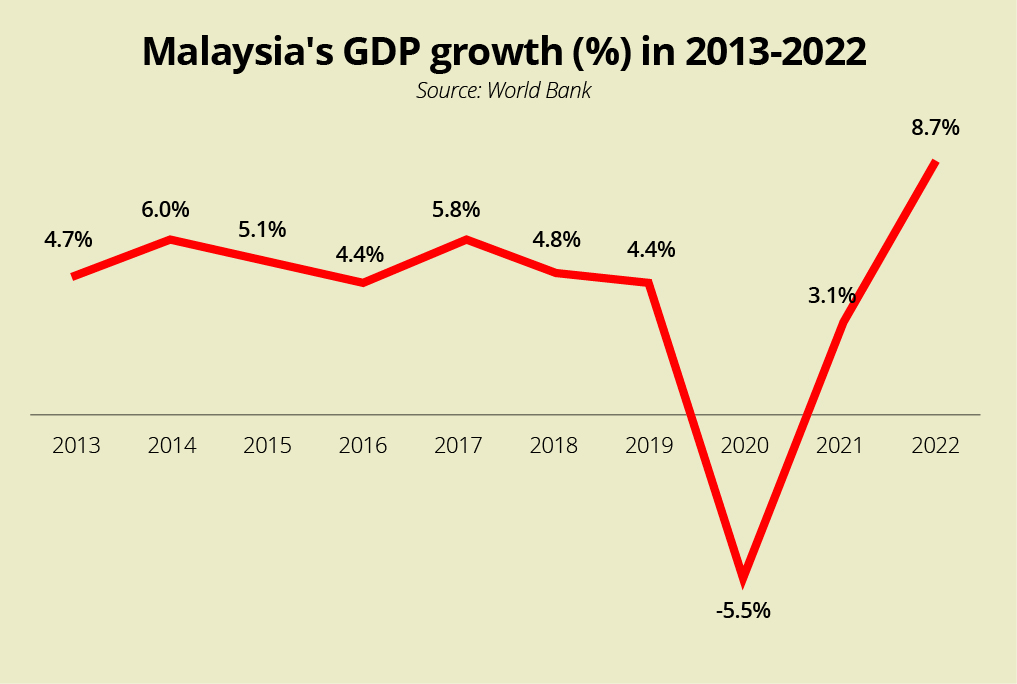

Malaysia’s economy has not been growing strong enough in recent years and this has a negative impact on first-time home buyers. Hit by the slow pace of wage growth, rising inflation rate, vestiges of the pandemic and a series of OPR hikes, many of them have been rejected in their applications for housing loans. Unless financing institutions take stock of the phenomena affecting their income and accommodate the reality of changing income profiles in their assessment, first-time home buyers will be disenfranchised from home ownership. This is the consensus reached at the StarProperty Budget 2024 Roundtable discussion among property developers.

Banks’ preoccupation with a healthy credit rating based on debt-servicing-ratio, CTOS, CCRIS and other financial history checkings is largely a picture up to the point of time of their loan application, developers said. Banks expend little consideration for factors beyond that point in time, such as the borrowers’ career development prospects.

Methods not keeping up with times

Sime Darby Property Bhd group managing director Datuk Azmir Merican said in urban areas where there are better job opportunities, banks should also consider qualitative factors in their assessment such as the borrower’s career potential and not just their current level of debt commitment.

FIABCI-Malaysia immediate past president Datuk Seri Koe Peng Kang and Gamuda Land chief operating officer Wong Siew Lee said the current plight of first-time home buyers was reminiscent of their own experience when they were unable to secure home loans early in their career, indicating how little bank methodology has changed despite the times.

OSK Property chief operating officer Seth Lim Sow Wu pointed out that banks should also take into consideration those who are supplementing their main income with earnings from the gig economy, which has been on the rise with its ease of joining and aggressive recruitment.

He also urged banks to take into account the fact that a vast majority of first-time home buyers are unable to afford the 10% house deposit and need assistance such as a bridging loan or step-up financing. To assist them, some developers have gone the extra length of offering them bridging loans to cover their deposits and other fees.

Scientex Bhd chief operating officer Datuk Alex Khaw Giet Thye said many of the first-time home buyers whose loan applications were rejected included young people holding their first job or are involved in the gig economy and who attempted to purchase affordable housing priced below RM300,000. To help this group, banks should calculate risk differently.

Another issue affecting home financing is the valuation of the development. Developers lamented that valuers neglected to take into account the value-added upgrades and amenities they put into the surrounding area and gave a lower loan-to-value ratio, causing an issue of unaffordability to their buyers. Again, developers said that this stems from taking a risk-averse method of valuation which takes little into account the higher standards that the industry has invested in their developments.

Apart from developers, mortgage professionals speaking to StarProperty also said the tightening of bank credit has become more discernible in the last two years and is affecting home buyers in both primary and secondary markets.

Bank tightening is related to processes and interest rate

Diligent Planners mortgage sales director Vince Chia said that since the last quarter of 2021, financial institutions have become more cautious in approving housing loan applications. More applicants have failed to pass the bank assessment on their creditworthiness, which Chia said is based on their income stability, debt servicing ratio and employment history.

Chia observed that banks seemed to have streamlined their assessment process and shortened the turnaround time but he felt that the streamlined process was fixed and rigid.

“For example, take the case of a 30-year-old who just settled his hire purchase loan six months ago. He has had a good repayment history and did not have other credit facilities such as a credit card. But if he were to apply for a housing loan, he is in the risky group and might get rejected because of having no repayment record. But in fact, he had demonstrated good financial planning by committing to just one loan at a time. His application shouldn’t be denied,” he said.

“Another rigidity is in how a CCRIS report is processed. An applicant could be settling his credit card payment in full every month, but because a CCRIS report records payment at the end of the month, an applicant whose credit card payment due date is not at the month’s end will see his CCRIS report having outstanding payment. This will cause him a credit score issue with the bank and his application might get rejected,” he said, adding that there should not be a one-size-fits-all for every application. “Each application merits a different perspective and banks should make reference to the loan proposal and the mortgage salesperson’s recommendation.”

Anani Advisor chief executive officer Farid Razali contended that the primary reason that bank rejection has been on the rise is the OPR increases which caused many home buyers’ debt-servicing-ratio to rise as well.

“The OPR rate by the second quarter of 2023 has increased the repayment value of all existing loans that a home buyer might have. From the banks’ point of view, the applicant’s capacity to pay back has reduced, especially for the first-time home buyers,” he said.

“This is made worse by the expiry of My First Home Scheme (SRP) on 1st April this year. The scheme has been very helpful because those who took it up were own-users and their loan applications were more often than not approved by the banks,” he said, adding that the scheme should be revived because first-time home buyers constitute a large demographic in the property market.

“First-time home buyers form one-third of the total housing loan borrowers on a yearly basis,” he estimated.

Help for first-timers has a small reach

Ironically, the conclusion of SRP also sheds light on the limited extent to which assistance is available for first-time home buyers from the lower-income group. The SRP was launched in 2011 for first-time home buyers with a gross monthly salary of not more than RM5,000 or not more than RM10,000 for joint applicants and properties with a maximum selling price of RM500,000. Offering financing up to 110%, it has allowed home ownership for B40 and M40 Malaysians who could not afford the down payment.

According to the National Mortgage Corporation (Cagamas Bhd), which managed the SRP, more than 90,000 were successful applicants for the scheme. Divided by a period of twelve years, an average of 7,500 benefited every year. But when compared to the nearly 238,000 residential units transacted on average per year during the same period, the former is just 3% of the latter.

In July, the government also announced a RM5bil allocation to the Housing Credit Guarantee Scheme (SJKP) to help up to 20,000 first-time home buyers who are without fixed income such as gig economy workers, business owners, traders and small entrepreneurs.

For the long term, developers urged the government to improve the economy to lift the people’s income and their purchasing power. In a stronger economy and housing market, developers also will not be under pressure to suppress house prices, which might bring in the risk of having to compromise on quality and on-time completion. Improving the economy is crucial in making sure that Malaysians will continue to have access to quality and affordable housing in years to come.

Developers' recommendation

- A call upon all stakeholders of the housing market to alleviate housing affordability. For a more holistic coverage of the issue, all stakeholders, such as property developers, financial institutions and more should be involved.

- Accommodate the changing economy by adjusting the methods of risk profiling when considering housing loans.

- During the construction period, homeowners will only be paying interest. Their debt-to-service ratio (DSR) is in actuality, lower during the period. This should be taken into account when ascertaining their payback capacity, rather than basing the DSR solely on the repayment of the entire amount.

- Create a step-up installment initiative that progresses as the wealth of the buyer progresses.

- Improve upon the method of property development valuation.

Chia said each loan application merits a different perspective and banks shouldn’t apply a one-size-fit-all assessment method.

OPR increases in the past year have led to the spike of debt-servicing-ratio and results in loan rejection, opined Farid.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.