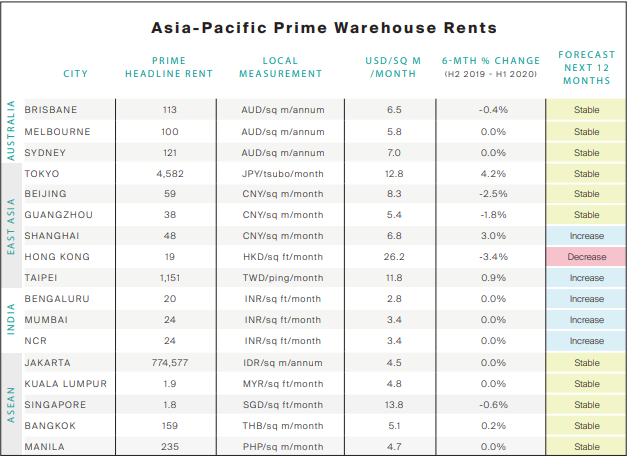

MALAYSIA: Knight Frank revealed in its latest report that prime warehouse rents across 17 key cities are registering an average change of -0.02% half-on-half despite the ongoing pandemic. Going forward, Knight Frank in its Asia-Pacific Warehouse Review expects average rental growth between 3% and 5% by the end of 2020.

Highlights:

- Market conditions for 16 of the 17 cities tracked are expected to remain stable or improve over the next 12 months. The positive outlook for growth in the second half of 2020 is due to higher space appetite from e-commerce players and essential commodities.

- Tokyo recorded the highest half-on-half rental growth at 4.2%, due to healthy take up rates and the lack of available prime assets within the city.

- Shanghai warehouse market recorded the healthiest rental growth compared to Beijing and Guangzhou, at 3% half-on-half, led in part by a pickup in storage demand from cold chain operators.

Knight Frank head of occupier services and commercial agency Tim Armstrong said, “The outlook for industrial markets remains resilient due to robust demand from the e-commerce and essential goods sectors, as well as additional requirements for inventory storage to mitigate supply chain disconnects.”

Asia-Pacific Prime Warehouse Rents:

Knight Frank Malaysia executive director of capital markets Allan Sim said, “In the ASEAN context, Klang Valley remains attractive in terms of warehouse rental competitiveness. Combined with our integrated ecosystem of accessible skilled labour and talent as well as investor friendly policies with favourable tax structures and attractive government incentives, this helps to put Malaysia at a competitive advantage amongst its neighbours in attracting multinational businesses that are diversifying their global supply chain and manufacturing operations to the region.”

Covid-19 gives rise to acceleration of “China Plus One” strategy adoption

According to Sim, Multinational Corporations (MNCs) have been looking to diversify their supply chains out of China over the past few years due to growing trade tensions between the US and China as well as rising labour cost in China.

More recently, the unprecedented disruptions arising from the Covid-19 pandemic further highlighted the risk of being over-reliant in managing and operating the supply chain out of a single country, China.

For many MNCs, the pandemic has become the deciding factor to adopt the “China plus One” approach to supply chain management. This is done by diversifying portions of the supply chain to other regional countries whilst maintaining higher value manufacturing operations in China with the adoption of digital transformation and automation. Sim said ASEAN countries are the immediate beneficiaries of this supply chain redesign.

Malaysia As Preferred Investment Destination Amongst ASEAN Countries

Sim commented that the various incentives unveiled under the RM35bil short-term Economic Recovery Plan (PENJANA) will help encourage more foreign direct investment (FDIs) flows. There is a generous tax holiday period of up to 15 years for foreign companies making new investments in the manufacturing sector with capital investments of RM500mil and above.

This coupled with the fast track approval mechanism for manufacturing licences and tax incentives with the establishment of Project Acceleration and Coordination (PACU) in the Malaysian Investment Development Authority (MIDA), will help to raise the country’s attractiveness in the eyes of foreign investors.

“With these timely incentives combined, our competitive real estate and labour costs, Malaysia will be positioned as one of the main beneficiaries amongst our ASEAN counterparts in capturing the shoring of manufacturing and supply chain operations amidst the on-going restructuring of global supply chains,” said Sim.

“We will also likely witness a positive spillover effect in other segments of the industrial property market, predominantly in larger purpose-built factories and large tracts of industrial lands, with the potential entry and relocation of new global industrial players,” Sim concluded.

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.