Freehold titles are still highly sought after, but their numbers and their weight in buying decisions are diminishing.

Freehold titles enable a claim of ownership in perpetuity – or for as long as there is land and a sovereign power to recognise that ownership. In contrast to freehold titles, leasehold properties are only owned for a fixed period – typically anywhere between 30 to 99 years (except for Sabah and Sarawak, where some old titles do carry a 999-year leasehold tenure).

The primary reasons for purchasing land or property, especially for most first-time home buyers, typically extend beyond the basic need for shelter. For many people, the advantage of being a homeowner comes with the privileges of inheritance and individual sovereignty – becoming the ruler of one’s own domicile and enabling one’s offspring to enjoy the same.

Photo by Suraj Patil on Unsplash.

“Freehold properties are the highest category of holdings since its tenure is forever. In other words, it is a grant in perpetuity,” says Datuk Paul Khong, the managing director of Savills (Malaysia) Sdn Bhd.

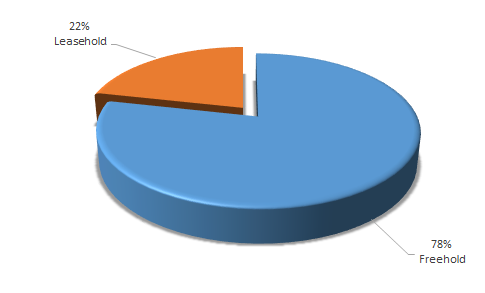

A recent Facebook poll supported this assertion by showing that the majority of respondents preferred buying a property with a freehold title rather than a leasehold title.

Do you prefer buying freehold or leasehold?

Of the 120 respondents who participated in our Facebook poll, only 22% indicated a preference for buying property with a leasehold title while the majority (78%) said they would prefer buying freehold property.

When considering a purchase decision solely based on a decision between a freehold or leasehold title, the choice is clear – home buyers prefer the certainty of ownership in perpetuity. That distinct preference gets muddled when the question is framed in the context of considering other factors that typically go into the purchase of a property.

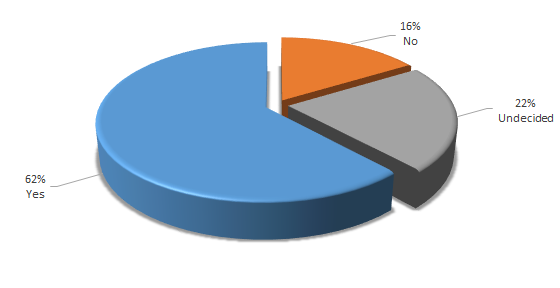

Is tenure relevant as a criterion when buying property?

In our 2018 Buyer Sentiment Survey, 62% of the 1,786 respondents indicated that the tenure of a property's title is a relevant factor to consider when buying a piece of property, while only 16% felt it was not a factor worth considering and 22% remained undecided.

When considering the tenure of a title against other factors that typically arise when approaching the decision to purchase a property, the possibility of ownership in perpetuity evidently became less important.

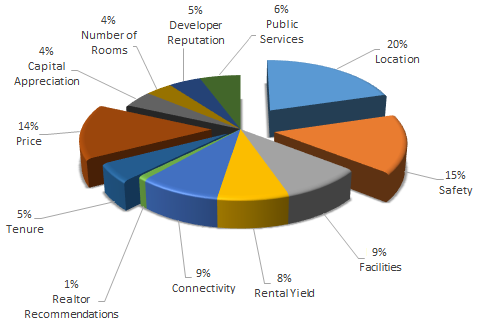

What are the top three criteria to consider when buying property?

Location, safety, and price were consistently the top three criteria selected by the majority of respondents in the 2018 Buyer Sentiment Survey. The tenure of title became less important a factor when considered alongside other criteria – factors such as the availability of public services, facilities, the connectivity of the neighbourhood's roads, and the potential rental yield became more important.

Freehold properties are getting scarcer – and that perpetuity is not guaranteed.

According to Datuk Paul Khong, “Today, the number of freehold titles are diminishing, and newer projects are moving towards leasehold lands. Usually, freehold projects are developed from old freehold plantations which were mostly given the titles centuries ago.”

“As freehold lands become scarce and pricey, developers have shifted their focus to secure more state alienated lands to develop their high-rise strata projects,” says Datuk Paul Khong.

Photo by Hrvoje Klaric 🇭🇷 on Unsplash.

It is partly due to our need for ownership in perpetuity that freehold land titles are so highly valued and sought after – but even in this age, with the world being almost entirely democratic, home buyers often neglect the fact that eternal land titles can be converted to grants for a fixed number of years, or purchased by the government in a procedure known as forced acquisition.

With a higher degree of development necessitating master plans of greater density and depth in the urban era, governments are increasingly more likely to rely on converting freehold titles to leasehold, or forced acquisitions – in order to secure the land necessary for strategically located infrastructure projects and homes to support growing populations.

The possibility of forced acquisitions, or freehold titles being converted to leasehold, may have been lesser concerns for previous generations of home buyers – when there used to be considerably more land to go around. In less developed times, the government could acquire wide swathes of buildable land without having to infringe on the sanctity of private ownership.

How does it impact me?

Despite the real possibility of governments reacquiring property, often at prices determined by their choice of valuers, freehold properties continue to yield the highest rates in capital appreciation and rental.

The difference in price between properties with freehold and leasehold titles may be due in large part to perception, as Datuk Paul Khong puts it, “Every investor tends to look for a landed residential property with a freehold title, which is perceived as the ultimate position. Anything less will call for a discount on price and lessen its appeal.”

Vicky How, a licensed valuer registered with the Malaysian Board of Valuer, Estate Agency and Appraisal (BOVAEA) and a director of Henry Wiltshire, an international estate agency company, further describes the reason for the declining value of leasehold titles, “The shorter the lease, the less value it has and many banks may not approve the loan if the remaining lease of the land is less than half of the 99 years lease. If the tenure of the lease remaining is less than 40 to 50 years, the purchaser can only purchase with cash in hand.”

As the remaining tenure of a leasehold title decreases with the passage of time, a leasehold property is understandably viewed as less valuable – ownership lasts only as long as the lease is valid and any renewal premiums due would be factored into the selling price by prospective buyers as the initial costs of ownership.

“Even if the land is acquired cheaply, the premium to be paid for the renewal/extension of the lease may be more expensive in comparison to the price of purchase which is valued relying on the remaining lease over the land,” says Vicky How.

What can I do about it?

The extension of a lease is subject to the government’s master plan for the area – leases for land in developed areas are more likely to be extended, albeit often for shorter periods – and an extension of a lease requires the payment of a premium that is dependent on the type of property. Datuk Paul Khong says, “There is a possibility of renewing the leasehold title but it is subject to a new premium payable to the state and renewals are usually only sorted within the last 10 years or less before its expiry.”

According to Vicky How, “The Valuation and Property Services Department (Jabatan Penilaian dan Perkhidmatan Harta) will value the property to determine the market value of the land. The premium is calculated differently in each state and the rules applicable in Selangor are under Section 7 of the Selangor Land Rules 2003 and Selangor Quarry Rules 2003 entitled “Premium” – which is calculated as follows (excluding the price of the building constructed on the land): Premium = ¼ × 1 ÷ 100 × Market Value of the Land × Number of Years of Renewal × Land Area (in square feet).”

Christopher Chan, associate director of Hartamas Real Estate (Malaysia) Sdn Bhd, details the process of extending the tenure of leasehold titles.

What happens when a lease expires?

There is no compensation due to the owner for the expiry of a lease – once the lease expires, ownership of the land reverts to the state. As Vicky How puts it, “Upon expiry of the lease, the ownership of the land reverts to the state authority including any construction upon it.”

According to Datuk Paul Khong, “The leasehold renewal rights rest with the state and is not a lawful right of the leasehold owner. However, residential properties usually stand a higher chance of renewal, unless the state has some major redevelopment plans for the particular area.”

Conversions of property titles from leasehold to freehold are not completely unheard of – the necessary provisions for such conversions already exist in Malaysia’s current National Land Code.

In July of 2018, the state government of Negeri Sembilan pledged to convert leasehold properties with titles nearing expiry to freehold – with a formal request for a conversion of one property made by any individual who holds more than one leasehold title, and subject to the approval of the federal government.

Why choose leasehold properties?

According to Vicky How, leasehold titles can be the more practical choice, "Despite all the aforesaid factors, it would be ideal to purchase the leasehold property as it is more affordable in comparison to a freehold property – and the value of property with 99 years remaining in a leasehold title tends to go up in value for the first twenty-five to thirty years of the leasehold tenure.

"Location may also play a factor as a leasehold property or land in preferred locations in Kuala Lumpur and Selangor may be cheaper compared to a freehold property in the same area. Furthermore, leasehold property with less than 40 to 50 years tenure is ideal for short-term farming or storage purposes, in comparison to year-to-year tenancy to lock in the price."

But in Datuk Paul Khong's view, there is a downside to leasehold titles, “We can observe Petaling Jaya Sections 1 to 3 (for example, the Petaling Jaya Old Town area) and note that the rejuvenation factor in the neighbourhood is rather weak when the leasehold shortens below the 50-year tenure. These areas become blighted and the redevelopment of existing old houses becomes minimal. These neighbourhoods lose their shine and age with the times.”

Datuk Paul Khong is the managing director of Savills (Malaysia) Sdn Bhd. Savills is a global real estate services provider listed in the London Stock Exchange with more than 600 offices and associates in over 60 countries. Read Datuk Paul Khong's original contribution here.

Vicky How is a licensed valuer registered with the Malaysian Board of Valuer, Estate Agency and Appraisal (BOVAEA). She is currently a director of Henry Wiltshire, an international estate agency company. Read Vicky How's original contribution here.

The views and opinions expressed in this article are solely those of the contributors. These views and opinions do not necessarily represent those of StarProperty.my.