House buyers sentiment to improve in line with vaccination programme

By Viktor Chong viktorchong@thestar.com.my

It appears that the Covid-19 pandemic is losing its momentum, with the reducing number of cases being recorded every day. Since the property market’s performance is very much pegged to the nation’s economy and health, there are speculations that the worst is over.

According to University Malaya associate professor Rosli Said, the overall sentiment for 2021 will be slightly better than last year due to the start of the vaccination programme. However, the recession coupled with an increase in the unemployment rate and economic and political uncertainties will not be helpful. Upon successfully implementing the vaccine, he forecasted that the year 2022 should be the starting point of recovery.

This is based on the previous trend where the property market lagged behind the economic cycle by around one to two years. He said there is no good or bad time to enter the market, but buyers can take advantage of the current low interest rates and the availability of subsale properties.

Kong said the vaccine has given fresh impetus to buyers and sellers making a last-ditch attempt to take advantage of the stamp duty holiday and complete transactions.

Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector Malaysia (PEPS) president Michael Kong agreed that the economy is beginning to recover from the pandemic’s effects. He pointed towards the third quarter (Q3) of 2020, where the property sector recorded 89,245 transactions worth RM33.78bil.

This showed an increase of 7.4% in volume but a decrease of 2.4% in value compared to Q3 of 2019, which registered 83,085 transactions worth RM34.62bil. While sales have soared, the value dipped a little. He said this is consistent with the market sentiment and buyers are more discerning now that they are picking up good bargains.

Residential market warming up

A property survey presented by the Real Estate Housing Developer Association (Rehda) president Datuk Soam Heng Choon said there were fewer unsold residential units in the second half (2H) of 2020 (64%) compared to the 2H of 2019 (71%). Based on the survey, terraced house registers at the highest among the unsold product types (30%).

This was followed by semi-detached and bungalows at 29% and apartments and condominiums at 26%. From the survey, 69% of the respondents said their unsold completed residential units are currently aged around 13 to 36 months.

Soam said the number of units launched and sales performance are retained at almost the same number as the previous two halves.

On pricing, Rehda found that units from RM250,001 to RM500,000 make up the highest percentage of unsold units for the 2H of 2020. Soam said lower prices are not the only determinant to sell a home as there are also unsold stocks below the RM100,000 mark.

These recorded a rate of 3% for both the 2H of 2020 and 2019. The top reasons why units are unsold are manifold, such as end financing loan rejection, unreleased Bumiputera units and low demand. With regards to the secondary market, Malaysian Institute of Estate Agents (MIEA) did a survey in 2020, and the results were encouraging. The 420 respondents consisted of individual real estate agents, real estate negotiators and real estate agencies as a whole.

Based on the survey, 42.86% of respondents said sellers had not lowered prices, while 31.43% claimed a price reduction of less than 10%. “There are projects that do well in 2020, even with the pandemic at full-blown, such as landed homes in the suburbs,” said MIEA president elect Chan Ai Cheng, adding that the residential rental market remains steady.

“As a general rule, residential landed properties are more resilient,” said Chan.

“Based on our organisation research, the price of strata residential development in Klang Valley has shown a negative adjustment between 5% and 10% as compared to the transacted prices of 2018 and 2019,” said Rosli. But the rest of the sectors have not shown any significant evidence to prove the adjustment of the value. Rosli opined that there is still a possibility for a quick recovery if the vaccination programme is fully deployed. However, residential prices are expected to fall nationally if the overhang situation is not solved within 2021 and 2022.

Slow recovery for commercial and hospitality sector

Chan said the retail sector is possibly the biggest hit since transactions declined while the cost of business remains the same or has increased. These factors will put a lot of pressure on tenants to continue to service their rents. The survey by Rehda found that shop lots and shop offices represent an overwhelming 77% of unsold commercial units.

According to Soam, office towers may be excluded from the statistics since member developers rarely build those. Marketwise, commercial units between RM RM500,001 and RM700,000 make up the highest unsold rate at 25%. Moving on, interstate and interdistrict restriction has severely hampered the hospitality sector, not considering the barriers to entry for foreign tourists.

“The situation also forced most hotels to reduce the room rate by more than 50% in order to attract visitors. In addition, the cancellation of Visit Malaysia Year 2020 further deteriorated the hospitality sector,” said Rosli. He believes the hospitality sector will have a longer lagging period behind the residential and commercial sectors, and the recovery may only happen by 2022.

Rosli said industrial facilities, especially those built-to-suit facilities, are expected to maintain their price.

Inversely, several industrial sub-sectors benefited immensely from the pandemic, namely the manufacturers of gloves, masks and health equipment. Logistic and warehousing experienced more demand due to the e-commerce boom created by the online shopping trend during the pandemic. Rosli foresees that this trend will not dissipate even after the pandemic is over.

“Under our portfolio, there are a couple of international clients who requested for market and feasibility studies on industrial properties during the pandemic. Most of them are interested in the built-to-suit industrial facilities,” he said, adding that another healthy indication came from several real estate investment trust companies who purchased warehouses to diversify their investment portfolio.

Deciphering the future

The issue of unaffordable housing has been an ongoing matter for many years, especially in urban areas. A straightforward solution to this conundrum is to build smaller units at lower prices. Kong said developers are already coming up with various shoe-size small-office-home-office (SoHo), small-office-versatile-office (SoVo) and small-office-flexible-office (SoFo) units.

For landed properties, some developers are marketing zero-lot bungalows and cluster bungalows which are actually redesigned semi-detached houses. Despite the trend, he advised developers to be cautious about the buyer’s size preferences as shoe sized units may not be palatable for Malaysians. “I believe terrace houses are the most resilient type of residential property in the Malaysian context.

It is the most preferred type of residential dwelling in my opinion and is mainly owner-occupied, thus, is more resilient and less susceptible to volatile changes,” said Kong. Chan believes space requirement is very important to facilitate the process of working from home. She said the trend could be moving out of the city to localities where homeowners can enjoy bigger spaces at affordable prices.

Towards the future, 49% of respondents from the Rehda survey said they plan to launch their projects in the first half (1H) of 2021. Strata units will make up the bulk of the incoming supply at 6,998 units, with the majority priced between RM250,001 and RM500,000. In addition, 5,876 units will be landed property, and 163 are commercial units.

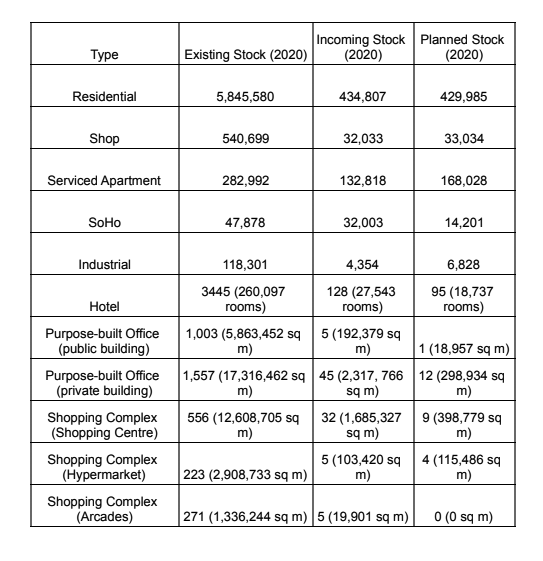

Overall Property Supply 2020

Stay ahead of the crowd and enjoy fresh insights on real estate, property development, and lifestyle trends when you subscribe to our newsletter and follow us on social media.